👨🔬 Governance Lab #120

Lab Report #120 - ENS Working Groups Replacement, Sushi Emissions Push, CoW 2026 Budget Fight, and more

Welcome back to the Governance Lab, your weekly source for all things StableLab, DeFi, and DAO Governance.

At a Glance 👀

🔵 ENS DAO rejects a proposal to replace working groups

🟢 Sushi DAO votes on raising the SUSHI emissions ceiling

🟠 CoW DAO rejects bundled 2026 core funding request

🧪 From the Lab: Measuring PYUSD Adoption & Meet Nneoma at Solana Breakpoint

Let’s dive in 🏊

ENS DAO

ENS DAO rejects proposal to replace working groups

ENS DAO has voted down social proposal [6.25] “[Social] Replace the Working Groups with the ENS Admin Panel,” which sought to wind down the Meta-Governance, Ecosystem, and Public Goods Working Groups at the end of Term 6 and replace them with a small Admin Panel from January 1, 2026. The measure, introduced by limes.eth and discussed on the ENS forum, argued that working groups incentivize soft consensus and make it hard to curate contributors, and that a leaner structure would improve accountability. A Snapshot vote in the ENS space rejected the change, keeping the existing working group model in place.

The proposal would have created a single Administrator plus four multisig Signers to execute transactions on former working group multisigs, pay KPK performance fees, enforce reporting from service providers and ENS Labs, and optionally host quarterly town halls, without running grants programs or weekly calls. Compensation was specified at 120k USDC per year for the Administrator and 12k USDC per year per Signer, with unspent working group funds returned to the DAO and control of multisigs transferred to the new Admin Panel if it passed.

Forum feedback highlighted concerns that replacing working groups with a small Admin Panel could concentrate decision-making, weaken ENS’s accessibility for new contributors, and undermine its public-goods mandate, even if tokenholder control of the treasury remains. With this proposal rejected, ENS will continue to operate via its existing working group structure while delegates consider alternative governance reforms, including retrospectives on working group performance and more incremental changes to incentives and accountability.

Sushi DAO

Sushi DAO votes on raising SUSHI emissions ceiling to 5% to deepen liquidity

Sushi DAO is voting on a Snapshot proposal, to raise the SUSHI Annual Emissions Rate (AER) from 1.5% to up to 5% of total annualized supply. The proposal aims to focus additional emissions on deepening AMM liquidity on core networks, supporting higher-quality token listings, structuring private-capital liquidity deals, and funding growth programs like aggregator incentives and Blade protocol-owned liquidity (POL).

At an estimated 285M SUSHI supply, the new ceiling would allow up to ~14.25M SUSHI per year versus ~4.28M today, creating roughly 10M SUSHI of extra annual headroom to deploy. Emissions would be adjusted dynamically by the core team based on KPIs such as TVL, volume, fees, and retention, with non-binding ranges that allocate roughly a quarter to a third of emissions each to core AMM liquidity and private-capital deals/Blade POL, and the remainder to new listings and targeted growth incentives. The authors frame this as using SUSHI emissions to structure longer-term, aligned liquidity arrangements rather than short-lived mercenary liquidity mining.

If approved, the change would increase near-term issuance and dilution risk in exchange for a chance to grow fee revenue toward a ~$20M ARR target and build a larger base of non-SUSHI treasury assets and POL that can be reinvested. The strategy explicitly links higher emissions today to a medium-term goal of relying more on protocol fees and a stronger treasury, with possible future options such as buybacks left for later governance decisions. Delegates are likely to track revenue per SUSHI emitted, POL and non-SUSHI treasury growth, liquidity and volume on core networks, and adoption of Ekubo-based AMMs as key indicators of whether the new AER ceiling is delivering sufficient return.

CoW DAO

CoW DAO rejects 2026 core funding and 100M COW top-up under CIP-76

CoW DAO has rejected CIP-76 “Continued funding for development services – Service Agreement No. 5,” a bundled proposal on the CoW forum and Snapshot. The CIP asked for 13.8M USDC from the treasury to fund CoW DAO’s 2026 operations via four legal entities defined in CIP-64, with monthly payments to the Core Team as Service Provider. In the same package, it requested a 100M COW top-up to the CoW Team Grant Allocation Committee for time-vested contributor grants.

According to the proposal, the USDC budget would cover engineering, infra, product, marketing and BD, and operations for a 40+ person team, using monthly invoicing and regular reports to increase transparency. The 100M COW component was pitched as long-term alignment, streamed over four years with unvested tokens cancellable by governance. Together, the two parts were presented as runway plus incentives to maintain and expand CoW Protocol across its existing and new networks.

Forum feedback showed many delegates were comfortable with continuing to fund core services but uneasy with the size and structuring of the 100M COW grant and the optics of team members voting on their own package. With the Snapshot vote rejecting CIP-76, the team has moved to separate a narrower operations budget from any future token-incentive request.

Links

🚀 Launches, Deployments, Partnerships, and M&A

Introducing HyENA

Tokenization Regatta is Live

Tempo Testnet is live

Stable Mainnet is live

📑 Reads, Insights, and Reports

ICOs are back: What crypto-native teams need to know

🔒 Security, Risk, & Hacks

🧗 Milestones & Updates

Arbitrum DAO - Entropy Advisors Monthly Update: November 2025

Gnosis DAO - Governance Summary ~ November 2025

ENS DAO - Update on the Endowment Fee Structure (Metagov + kpk)

Angela Kreitenweis joins Near House of Stake as Head of Governance

🗞️ Everything Else

ENS DAO - ENS Retro: An ENS DAO Retrospective & Stakeholder Analysis

Compound DAO - COMP Buyback Strategy — Nerite, Steer, Yearn, Summerstone & Uniswap v4 (Arbitrum)

📺 Podcasts, Presentations, & Listens

Lucas Bruder The Jito Endgame on Lightspeed Podcast

Proposal Tracker™️

💬 DISCUSSION | Sky Ecosystem - Highly-liquid tokenized assets on Solana for Keel

Summary: This proposal opens a Request for Proposal (RFP) on the Sky governance forum for issuers and asset managers to onboard highly liquid tokenized assets on Solana for Keel’s Regatta initiative, aiming to deploy up to $500M into institutional-grade assets by Q1 2026 in partnership with Sky and the Solana Foundation. It seeks tokenized high-quality liquid assets and short-duration investment-grade fixed income, with submissions evaluated under Sky’s Risk Capital framework (informed by Basel III) on returns, liquidity, regulatory compliance, operational robustness, and capital efficiency.

From the Lab

Measuring PYUSD Adoption: TVL, Cohorts, and Real Usage

In our latest blogpost, we analyzed PYUSD growth onchain, looking at ~2M transfers across ~70k wallets on Ethereum and Solana to see where real usage lives versus where incentives just push TVL.

We break down how a small set of whales and issuer treasuries drive most flows, how Solana’s big PYUSD ramps line up with incentive waves, and how Aave, Kamino, Drift, and Curve compare once rewards cool, then translate that into concrete lessons for teams designing stablecoin and RWA programs.

▶︎ Read the full post

▶︎ Visit the PYUSD Forse Terminal

Nneoma at Solana Breakpoint Abu Dhabi

Our very own Nneoma Kanu, Technical BD Lead, is in Abu Dhabi for Solana Breakpoint from December 11–13 to talk all things governance, protocol growth capital, and the future of Solana. Message us to meet up!

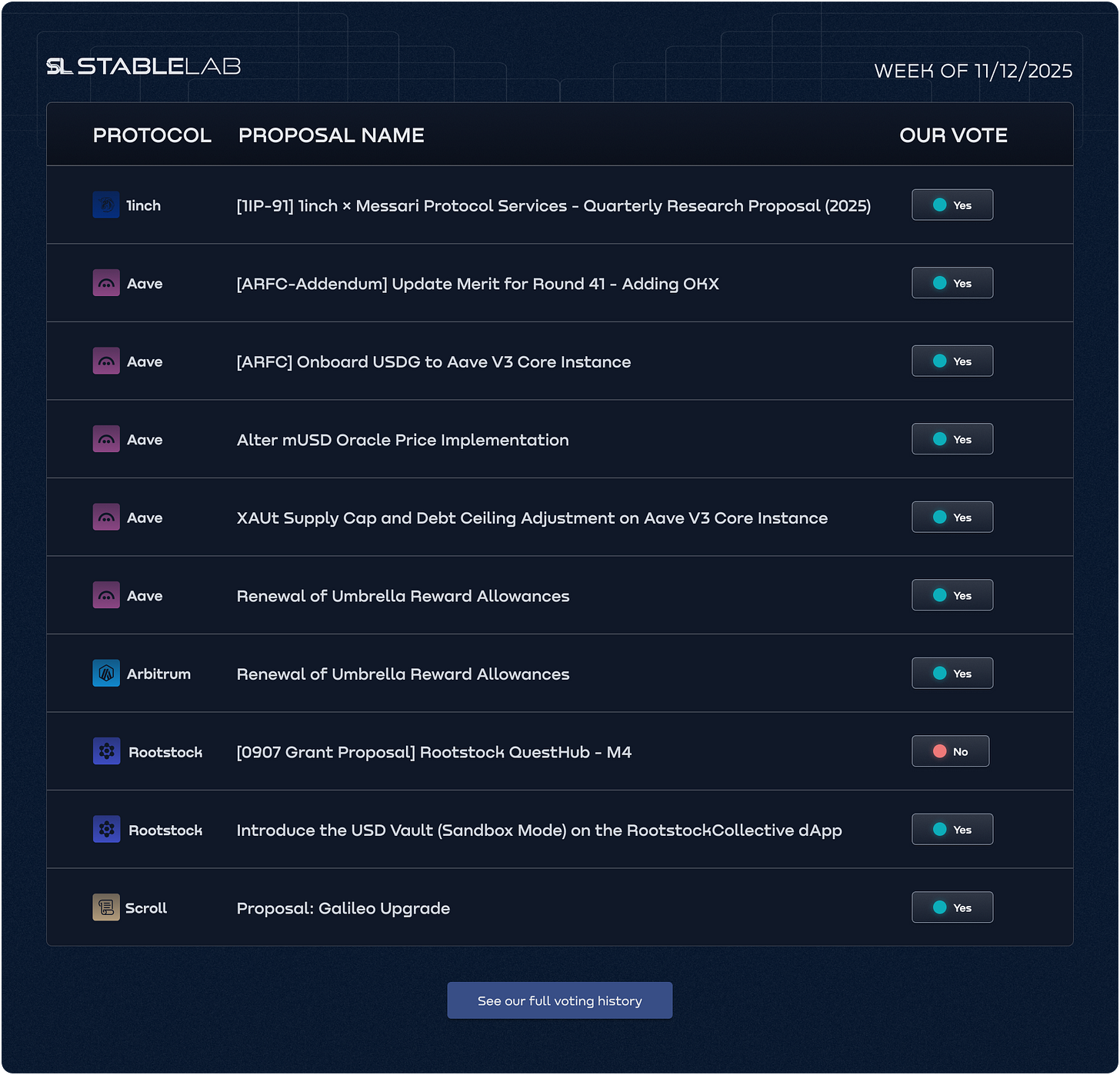

❲ Our Voting ❳

📆 December 5th → December 11th | 🗳️ Total Votes: 10

See our full vote history and detailed rationale HERE.

Meme

💌 FOLLOW US

Website | Twitter | YouTube | Mirror | LinkedIn

🤝 DELEGATE TO US @ stablelab.eth

Tally | Boardroom | Linktree

Great roundup! That CoW DAO rejection is interesting becuase separating operations budget from token grants seems like the obvious move but took a failed vote to get there. The 100M COW component probably spooked people on optics alone. Sushi's 1.5% to 5% AER jump feels agressive but if they can actualy structure longer-term POL deals instead of mercenary farming it could work.