👨🔬 Governance Lab #119

Lab Report #119 - Aave’s Multichain Reset, Lido’s 2026 Grant Plan, Compound’s Foundation Reimbursement, and more.

Welcome back to the Governance Lab, your weekly source for all things StableLab, DeFi, and DAO Governance.

At a Glance 👀

🔵 Aave DAO tightens its multichain playbook

🟢 Lido DAO considers a 58.2M USD grant request for GOOSE‑3

🟣 Compound DAO weighs a 1.10M USD USDC transfer to reimburse the Foundation

🧪 From the Lab: Scroll d/acc Report & Introducing the Forse Grants Management Platform

Let’s dive in 🏊

Aave DAO

Aave DAO runs Temp Check to refocus Aave V3 multichain strategy

ACI has posted a Temp Check on the Aave governance forum that would narrow the set of Aave V3 deployments by raising reserve factors on underperforming chains, shutting down very low‑usage instances, and setting a hard revenue floor for any new markets. The proposal responds to several years of multichain expansion where some instances add cost and risk but very little income. The stated goal is to concentrate resources on chains that can support meaningful protocol revenue while keeping Aave present on leading networks.

According to the forum post, V3 instances generating less than 3M USD in annualized revenue (including Polygon, Gnosis, BNB Chain, Optimism, Scroll, Sonic, and Celo) would see reserve factors lifted to 25% for most stablecoins other than USDC and USDT, 20% for WETH, 15% for USDC and USDT, and 10% for GHO, with a 12‑month window to show improved revenue before offboarding may be proposed. The Temp Check also suggests sunsetting zkSync, Metis, and Soneium after long periods of low TVL and revenue, and introducing a requirement that new V3 deployments guarantee at least 2M USD in annual protocol revenue, with some community members pushing for a 2.5M USD floor backed by top‑up payments in stablecoins and AAVE if targets are missed.

If advanced through ARFC, this framework would shift Aave’s multichain approach from “be everywhere” to a smaller set of high‑priority deployments where foundations and chains commit to clear revenue targets and incentive support. Readers can watch for concrete reserve factor adjustment proposals per chain, specific deprecation timelines for zkSync, Metis, and Soneium, and follow‑up discussions on whether exceptions should exist for strategic deployments such as corporate chains or Superchain partners.

Lido DAO

Lido DAO considers 58.2M USD 2026 Ecosystem Grant Request to fund GOOSE‑3 Core and Growth goals

The Lido Labs Foundation has introduced the 2026 Ecosystem Grant gRequest (EGG), a unified funding proposal on behalf of Lido Labs Foundation, Lido Ecosystem Foundation, and Lido Alliance BORG to execute the GOOSE‑3 strategy in 2026. The request is framed as a way to move Lido from a single‑product liquid staking protocol toward a broader product portfolio while keeping the protocol resilient and the treasury in surplus. According to the forum post, the EGG combines Core protocol maintenance funding with Growth allocations and ties them directly to GOOSE‑3 goals.

The proposal requests a total of 58.2M USD, split into 43.8M USD in baseline spend and 14.4M USD in discretionary Growth reserves that would only be deployed once specific product milestones are met. Baseline spend includes 26.9M USD for Core maintenance across engineering, audits, infrastructure, validator operations, and monitoring, and 16.9M USD for Growth initiatives mapped to four goals: expanding the staking ecosystem through Lido V3 stVaults and institutional integrations, delivering a Lido Core upgrade via Curated Module v2 and Staking Router v3 with ValMart, scaling Lido Earn vaults across several user segments, and exploring new product lines and real‑world applications through small experiments with clear validation gates. Discretionary Growth funds are designed as a pool for liquidity, institutional integrations, additional hires, grants, and audits where initiatives show traction.

Compound DAO

Compound DAO considers 1.10M USD reimbursement to Foundation

Arana Digital has posted a reimbursement proposal that would send 1,096,535 USDC from the DAO’s Aera Vendors Vault to the Compound Foundation. The transfer would compensate the Foundation for 30,500 COMP it provided so governance proposals 504 and 510 could meet onchain requirements for COMP transfers through the Comptroller after user reward claims drew down the Comptroller’s balance.

According to the forum post, the reimbursement amount is based on pricing 24,000 COMP at 31.91 USD and 6,500 COMP at 35.54 USD, plus a 10% buffer to account for the Foundation advancing the assets ahead of DAO approval. The payment would be made in USDC rather than COMP because DAO‑controlled contracts, including the treasury and Comptroller, currently do not hold enough COMP to repay in kind, and the Foundation would then use the USDC to buy back COMP on the market.

If approved, the transfer would close out the Foundation’s short‑term fronting of COMP for these proposals and reduce the risk of governance execution being blocked by low reward balances in the Comptroller. The discussion highlights the tradeoff between maximizing COMP rewards for users and keeping enough COMP liquidity under DAO control to support transfers and other onchain governance actions.

Links

🚀 Launches, Deployments, Partnerships, and M&A

Flow pivots to DeFi

Introducing Drift v3: Built to Outperform

Uniswap integrates Revolut

📑 Reads, Insights, and Reports

Arbitrum [D]DAO: A Data-Driven Autonomous Organization (DuneCon25)

Reflections After a Year Away: Four Opportunities for Arbitrum’s Continued Excellence

ZKsync Association Operational Report 2024-2025

🔒 Security, Risk, & Hacks

Yearn Finance looted for $9M

Obol Governance Security Data

🧗 Milestones & Updates

🗞️ Everything Else

Aave DAO - List GHO on Aave V3 Aptos Market

Balancer DAO - Revoke Delegation of Governance Tokens in Treasury

Compound DAO - Adopt Optimistic Governance for Market Parameter Updates

EigenLayer - The Incentives Council

Lido DAO - Lido V3 Deployment update and upcoming voting details

Lido DAO - Conversion of Treasury Stablecoins into sUSDS or TMMFs

Morpho DAO - Vault V2 Specific Incentive Campaign

Starknet DAO - Proposal for StarkWare’s Delegation Program During v2 — Feedback Request

📺 Podcasts, Presentations, & Listens

Joe Andrews, Co-Founder & Head of Product of Aztec Network on 11am Club

What does real TradFi <> DeFi convergence look like? @ Sky Connect in Buenos Aires

Proposal Tracker™️

⚡ VOTE LIVE | Compound DAO - Adopt Optimistic Governance for Market Parameter Updates

Summary: This proposal would add an optimistic governance track for certain market parameter updates on Compound so routine risk and configuration changes can move faster while still giving tokenholders veto power. As described in the forum thread, approved updaters would be able to propose changes that take effect after a delay unless tokenholders object.

✅ SNAPSHOT APPROVED | Aave DAO - Remove USDS as collateral and increase RF across all Aave Instances

Summary: This proposal removes USDS as collateral across Aave, raises its Reserve Factor to 25%, and adjusts related parameters to better match USDS’ risk and revenue profile. According to the forum post, it also sets USDS LTV to 0%, removes USDS from stablecoin e-Modes, and is supported by LlamaRisk and Chaos Labs based on USDS’ limited revenue contribution and changing underlying risks.

💬 DISCUSSION | Lifinity - Shutdown Lifinity

Summary: This proposal asks veLFNTY holders whether to shut down Lifinity and distribute all DAO and team assets to token holders or keep the protocol running as it is. It outlines a 7-day on-chain vote with a 15% quorum and core team abstaining; if “shut down” wins, Lifinity and Flare DAO assets would be converted to USDC and made claimable pro-rata by xLFNTY holders for 12 months before any unclaimed funds and airdrops are redistributed to claimants, while a “continue” outcome would leave current operations unchanged.

From the Lab

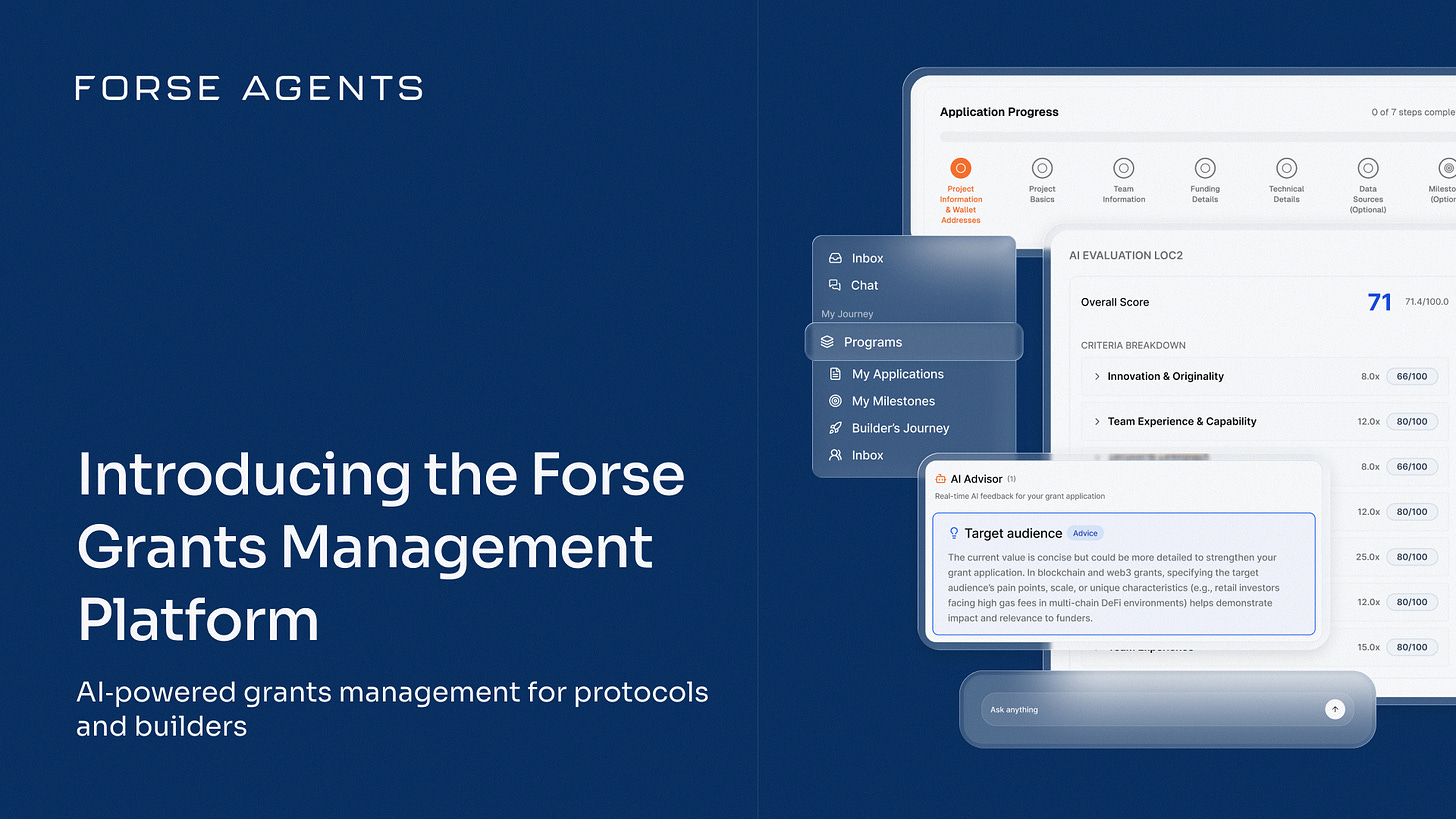

Introducing Forse Grants Management Platform

We’ve introduced the Forse Grants Management Platform, an AI‑powered system that helps protocols run grants programs end‑to‑end with real‑time intelligence, automated application guidance and scoring, and unified tracking of budgets and outcomes. The Forse Grants Management Platform is designed to move programs from ad‑hoc forms and spreadsheets to a single environment that shows which builders and grants actually move protocol metrics.

Scroll Delegate Accelerator (D/Acc)

We partnered with Scroll, SEEDGov, Factory Labs, Proxy, Open Source Observer, and contributors to design and run the Scroll Delegate Accelerator (D/Acc), an eight‑week, Notion‑based program that trained delegates through real assignments, scoring rubrics, and performance‑based rewards instead of ad‑hoc calls. The first cohort drew 80 applicants, kept attendance above 69% with 72.4% completion, and combined live workshops, Kahoot reviews, and practical exercises to move participants from governance basics to proposal writing, with 100,000 SCR delegated to high‑performing graduates and a full open‑sourced curriculum other DAOs can reuse.

▶︎ Read the final report and KPIs

❲ Our Voting ❳

📆 November 28th → December 4th | 🗳️ Total Votes: 11

See our full vote history and detailed rationale HERE.

Meme

💌 FOLLOW US

Website | Twitter | YouTube | Mirror | LinkedIn

🤝 DELEGATE TO US @ stablelab.eth

Tally | Boardroom | Linktree