👨🔬 Governance Lab #110

Lab Report #110 - Compound’s Gauntlet Renewal, Arbitrum’s DRIP Incentives, EigenLayer’s Programmatic Incentives v2, and more

gm frens 👋

Welcome back to the Governance Lab, your weekly source for all things StableLab, DeFi, and DAO Governance.

At a Glance 👀

🏦 Compound DAO weighs $2.3M renewal for Gauntlet partnership

💧 Arbitrum DAO launches DRIP with $24M for Season 1 lending incentives

🔐 EigenLayer proposes Programmatic Incentives v2 with higher EIGEN rewards

Let’s dive in 🏊

Compound DAO

Compound DAO weighs $2.3M Year 5 partnership with Gauntlet

Gauntlet has submitted a proposal to renew its partnership with Compound for a fifth year, requesting a fixed $2.3 million fee to continue managing risk and optimizing incentives across the protocol. The expanded scope includes coverage for up to 50 Comet deployments, weekly parameter reviews, monthly interest rate curve tuning, and support for new asset listings within five business days. The agreement also maintains a 30% insolvency refund, tying Gauntlet’s compensation to Compound’s market-risk outcomes.

Over the past four years, Gauntlet has provided more than 800 parameter recommendations, issued rapid risk alerts during market downturns, and supported Compound’s expansion to Base, Scroll, Sonic, Ronin, and other networks. The firm’s treasury management work through Aera has generated over $1.4 million in realized yield, while total unpaid debt across Comets currently stands at just $904, largely from dust accounts.

The Compound Foundation issued a statement in support of the renewal, citing Gauntlet’s continuity, experience, and alignment on broader strategic initiatives. The Foundation highlighted that introducing another risk-provider transition so soon after a recent vendor change would create unnecessary disruption, and that new contractual terms set higher service standards and tighter alignment with community priorities. The Foundation emphasized that Gauntlet’s expanded role will extend beyond risk services into product support, business development, and go-to-market initiatives, positioning Compound for growth in a more competitive environment.

Arbitrum DAO

Arbitrum DAO launches DRIP with $25M in incentives for DeFi lending

Arbitrum DAO has rolled out the DeFi Renaissance Incentive Program (DRIP), a four-season, $40 million initiative designed to channel incentives into targeted DeFi verticals. Managed by Entropy Advisors and powered by Merkl, the program is structured to reward specific actions that drive long-term growth rather than short-lived liquidity spikes.

Season 1 focuses on leverage looping in lending markets, with up to 24 million ARB allocated over ten two-week epochs running through January 2026. Incentives are distributed to users who borrow against yield-bearing ETH and stablecoin assets across six protocols: Aave, Morpho, Euler, Fluid, Dolomite, and Silo. Rewards are calculated based on time-weighted borrow balances, with select markets also offering supply-side incentives.

The program begins with a two-epoch discovery phase before scaling into performance-based allocations, directing larger rewards to more active and efficient markets. With DRIP, Arbitrum aims to consolidate its position as the leading DeFi ecosystem by making incentive distribution more competitive, transparent, and impact-driven across multiple seasons.

EigenLayer

EigenLayer proposes Programmatic Incentives v2 with higher rewards for EIGEN stakers

The Eigen Foundation has introduced Programmatic Incentives v2, the next iteration of its onchain rewards system for restaked security. The proposal would double the overall inflation rate from 4% to 8% annually—around 2.67M EIGEN per week—and increase the share directed to EIGEN stakers and operators from 1% to 4%. ETH stakers would continue receiving 3%, while 1% would be allocated to ecosystem growth and business development.

The Foundation argues that this rebalancing is a key step to grow the EIGEN staking base and accelerate application development on EigenCloud. Rewards under v1 contracts will continue until v2 is formally adopted, ensuring no disruption in accrual or claims.

If approved, v2 rewards would begin accruing the week following governance approval, with distributions continuing on a weekly basis. The Foundation notes this is the first step in an ongoing revamp, with future proposals expected to expand qualification criteria and refine incentive mechanisms as the ecosystem evolves.Links

🚀 Launches, Deployments, Partnerships, and M&A

BORGs live on AragonOSx

Introducing DRIP: The DeFi Renaissance Incentive Program

Welcome to Linea Ignition

📑 Reads, Insights, and Reports

How Much Does a Mature DAO Make a Year?

Ronin’s Return to Ethereum: Evaluating the L2 Proposals Shaping Its Next Chapter

Your Guide to U.S. Crypto Regulatory Developments

Value that Persists: Going Beyond Using Incentives to Rent Capital

🧗 Milestones & Updates

Aave DAO - V4 Development Update

dYdX DAO - Surge Season 6 Updates

Uniswap DAO approves DUNA Creation

Solana approves Alpenglow upgrade

🔒 Security, Risk, & Hacks

🗞️ Everything Else

Superfluid DAO - SUP Reserve Staking and Liquidity Provision

Lazy Summer DAO - Delegate Rewards Distribution (August)

Uniswap DAO - GLI Treasury Delegation Round 2

Uniswap DAO - GLI Incentivized Delegation Vaults

📺 Podcasts, Presentations, & Listens

Ethena: Stablecoins, Building Ethena, DATs and More on TG Podcast

Proposal Tracker™️

⚡ VOTING UNDERWAY | Uniswap DAO - Launching Uniswap v3 on Ronin with co-incentives

Summary: This proposal seeks approval for an official Uniswap v3 deployment on the Ronin Network, alongside a co-incentive program to bootstrap liquidity and establish Uniswap as Ronin’s primary DEX. Ronin has committed $1 million in RON tokens, while the Uniswap DAO is asked to match with $500,000 in UNI incentives distributed over six months.

💬 DISCUSSION | 1inch DAO - Treasury Funding for 2025 Security Audits of New & Upgraded Protocols

Summary: This proposal requests allocating $1.36 million USDC from the DAO treasury to 1inch Limited to fund independent security audits for all new protocol launches and major upgrades planned in 2025. The funds would be disbursed upfront, with 4–6 external auditors engaged per release and all reports published publicly before deployment. While the proposal highlights 1inch Limited’s audit track record, some community members have requested more detail on the budget breakdown, audit scope, and providers before advancing further.

💬 DISCUSSION | World Liberty Financial - Use 100% of WLFI Treasury Liquidity Fees for Buyback & Burn

Summary: This proposal would allocate all WLFI treasury liquidity fees to a buyback-and-burn mechanism, permanently removing tokens from circulation. Supporters view it as a way to strengthen token value and align incentives with holders, while critics warn it may limit treasury resources for operations and growth initiatives.

From the Lab

Unichain Co-Incentives Growth Mangement Plans

We’ve submitted an onchain proposal to the Uniswap DAO following its prior Snapshot approval in late June. The plan introduces KPI-gated incentives designed to grow USDS adoption across priority pools and markets, with contributions from Sky, Spark, and other DeFi partners. Funds will be deployed in tranches, tied to measurable usage and liquidity milestones, ensuring accountability and DAO oversight.

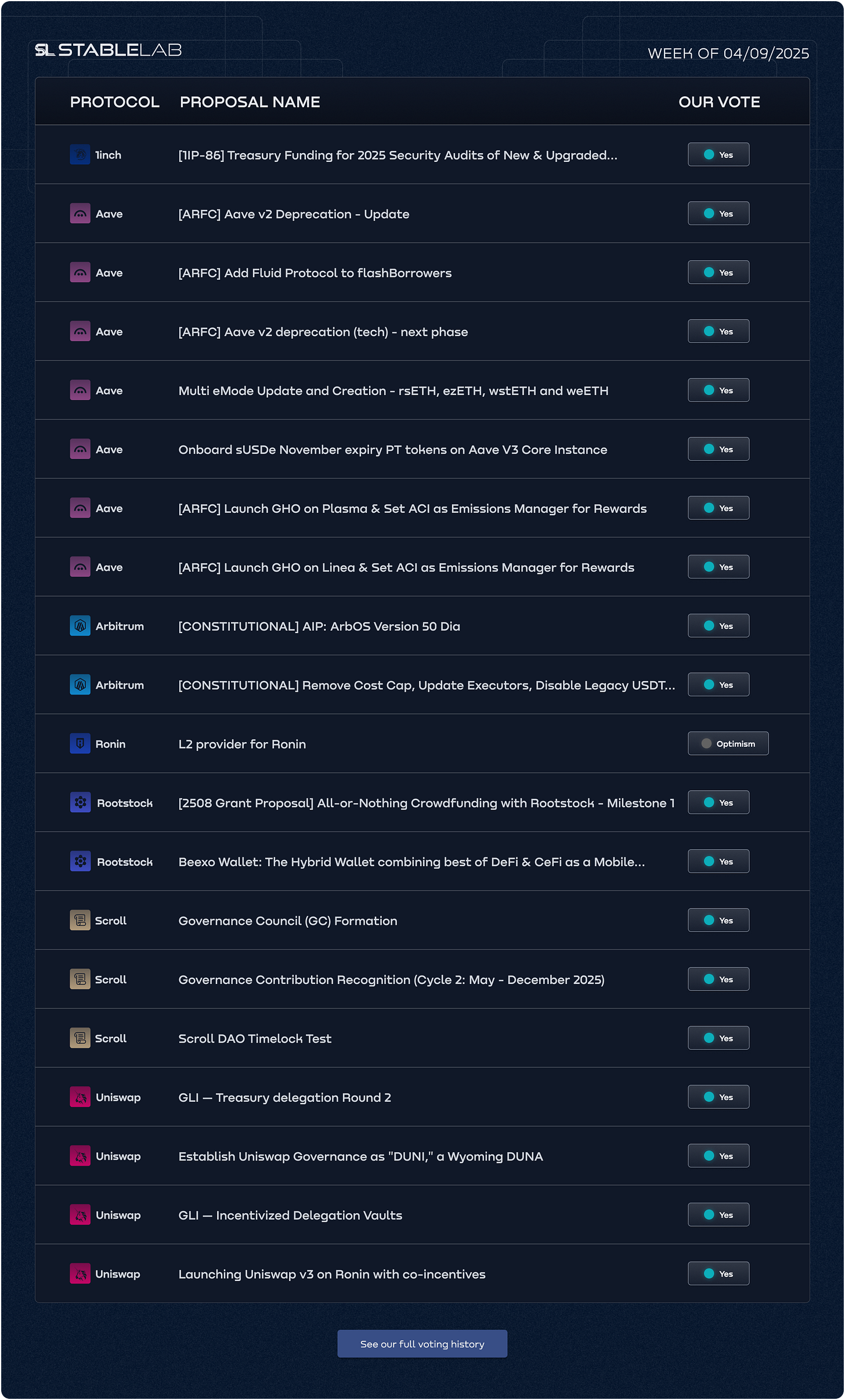

❲ Our Voting ❳

📆 August 29th → September 4th | 🗳️ Total Votes: 20

See our full vote history and detailed rationale HERE.

Meme

I’d love to hear from you! Drop me a DM on Twitter with your thoughts, feedback, or any comments you may have about the newsletter. I write for you, the reader :)

💌 FOLLOW US

Website | Twitter | YouTube | Mirror | LinkedIn

🤝 DELEGATE TO US @ stablelab.eth

Tally | Boardroom | Linktree