👨🔬 Governance Lab #107

Lab Report #107 – CoW DAO’s Retro Funding Launch, dYdX’s Grants Committee Proposal, Scroll’s Treasury Strategy RFC

gm frens 👋

Welcome back to the Governance Lab, your go-to weekly source for everything StableLab, DeFi, and DAO Governance. Please note that there will be no newsletter until mid-August, as I'll be out of office.

At a Glance 👀

🐮 CoW DAO seeks to launch first retro funding round

📊 dYdX Foundation requests $8M to relaunch grants program

🧾 Scroll DAO opens RFC for treasury management RFP to shape financial strategy

Let’s dive in 🏊

CoW DAO

CoW DAO discusses launching its first retroactive funding round

The CoW DAO Grants Council has proposed its first retroactive funding round, aimed at rewarding contributors for measurable ecosystem impact delivered over a 4-month build period. Inspired by Optimism’s RetroPGF model, this round flips the traditional grants structure—funding completed work rather than speculative promises.

Builders will be invited to develop and ship projects between August and November 2025, with applications evaluated in December. Final award distributions are expected by year-end. The program is structured like a focused hackathon, with clear thematic tracks and a shared review process led by the Grants Council and external technical reviewers.

Five priority areas were identified: solver infrastructure, developer tools, MEV protection research, AI agent infrastructure, and UX/education. Contributions will be judged on implementation quality, ecosystem value, and alignment with CoW’s mission. Awards will start at 5,000 xDAI and 5,000 vested COW, with higher amounts based on demonstrated impact.

This initiative introduces a performance-first approach to ecosystem funding and seeks community feedback before being finalized. If approved, the program will be funded through the Grants Council’s existing budget.

dYdX DAO

dYdX DAO proposes $8M in DYDX for new Foundation-led Grants Program

The dYdX Foundation has introduced a proposal to allocate 8M DYDX from the DAO treasury to relaunch its grants initiative under a newly established entity, dYdX Grants Ltd. The proposal would replace the existing Ecosystem Development Program (DEP) and consolidate governance, operations, and oversight under Foundation control.

Under the plan, the Foundation would assume responsibility for ~$2.3M in existing commitments and receive ~$1.85M in DEP assets, including DYDX and USDC. The new program will span 12–18 months and target ecosystem priorities across infrastructure, token growth, and R&D. Grants will be milestone-based and issued by a Foundation-hired Grants Lead, supported by the full dYdX Foundation team.

The Foundation argues the shift will reduce overhead, increase capital efficiency, and improve strategic alignment across ecosystem stakeholders. Community feedback is being collected ahead of an onchain vote expected August 4.

Scroll DAO

Scroll DAO explores treasury management strategy with Request for Comments on upcoming RFP

The Scroll Foundation’s governance team has introduced a RFC to gather community input ahead of a forthcoming RFP for DAO treasury management services. The RFC seeks feedback on how the DAO should structure its treasury governance strategy, including risk parameters, provider selection processes, and long-term financial objectives.

The goal is to design a robust framework for treasury diversification, risk management, and sustainability. The proposed RFP would invite qualified service providers to support Scroll DAO in implementing this strategy. Candidates could include treasury management DAOs, financial modeling teams, and DAO-native strategists.

Key questions posed to the community include preferences around provider selection (e.g. DAO vote, Foundation veto), appetite for a single vs. multiple providers, and specific priorities such as stablecoin diversification or on-chain execution frameworks. The RFC also revisits earlier discussions about forming a treasury working group, although initial sentiment favors Foundation oversight with DAO accountability.

The feedback window closes August 5, with a finalized RFP expected to launch August 6 and close August 15. The initiative marks an important step toward formalizing Scroll’s financial infrastructure and aligning its treasury with the protocol’s long-term goals.

Links

🚀 Launches, Deployments, Partnerships, and M&A

Obol Collective Delegate Reputation Score is live

📑 Reads, Insights, and Reports

🧗 Milestones & Updates

Arbitrum DAO - July 2025 DRIP Update

Near House of Stake live August 7th

Lido DAO - Delegate Oversight Committee Quarterly Report ( Q2, 2025)

Livepeer - GovWorks First-Term Overview

🔒 Security, Risk, & Hacks

🗞️ Everything Else

Aave DAO - Update forum features

Compound DAO - Trust-Minimized Treasury Management

Lazy Summer DAO - SUMR TR-WG Charter

Morpho DAO - Select LayerZero OFT to Bridge Morpho Token on Arbitrum

Safe DAO - Introducing the Safe Guardians of Gardens Safe Ecosystem Growth and Signaling

Velora DAO - Delegate Activation Program for Content Production

📺 Podcasts, Presentations, & Listens

Spark (SPK): The DeFi Protocol Redefining Finance with Explosive Growth and Innovation

Why Aave's Stani Kulechov Is Most Bullish on Ethereum 10 Years In

Proposal Tracker™️

⚡ VOTE UNDERWAY | Lazy Summer DAO – SUMR TR-WG Charter

Summary: This proposal seeks to ratify the Transfer Readiness Working Group (TR-WG) Charter, which outlines a structured roadmap for enabling SUMR token transfers. The group would deliver a Readiness Checklist, governance proposals (SIPs), tokenomics modeling, and communications strategy. The working group includes contributors from SummerFi, StableLab, DAOplomats, and others, with a total proposed budget of 120,000 SUMR. If approved, the group will operate through August with a milestone-based schedule and sunset automatically after delivering its final outputs.

🚫 VOTE FAILED | Euler DAO - EIP65 Activate all fees on Euler Lending

Summary: This proposal sought to activate all protocol fees on Euler Lending, including the reserve factor and governance fee. According to the proposal, enabling fees would have allowed the DAO to begin accumulating protocol revenue for potential use in grants, contributor compensation, or other governance-directed spending. The vote failed to meet quorum, with less than 20,000 EUL participating—below the 400,000 EUL quorum threshold.

💬 DISCUSSION | Velora DAO – Strategic Alignment Initiative (SAI) for VeloraDAO

Summary: Velora DAO contributors have introduced a Strategic Alignment Initiative (SAI) to guide near-term planning and define the DAO’s role within the broader Celo ecosystem. The RFC outlines a three-phase process: reflection on past initiatives, analysis of current DAO context and community needs, and articulation of a future-facing purpose and roadmap. The SAI would be community-driven and includes proposed activities like retrospective workshops, stakeholder interviews, and the development of a governance vision and funding scope. No budget is proposed at this stage.

From the Lab

Gnosis DAO Strategic Vision & Action Plan 2025-26

We’ve submitted a proposal at Gnosis DAO to initiate a structured overhaul of its strategic direction. The plan introduces quarterly directives, an experimental grants framework, and a governance accountability layer to drive long-term alignment across the ecosystem.

▶︎ READ the proposal

Monte Carlo Simulations of Tokenomics with Renee D

We're continuing our Interview Series—a collection of sessions with industry leaders sharing one big idea with our team. For Session 007, Renee D unpacked how Monte Carlo simulations can be used to stress test tokenomics and guide incentive design under uncertainty.

▶︎ READ the post

Ethereum Celebrates 10th Birthday

On July 30th, Ethereum celebrated the 10th anniversary of the Genesis block. StableLab has been a proud contributor to Ethereum, actively supporting key projects and DAOs across the network.

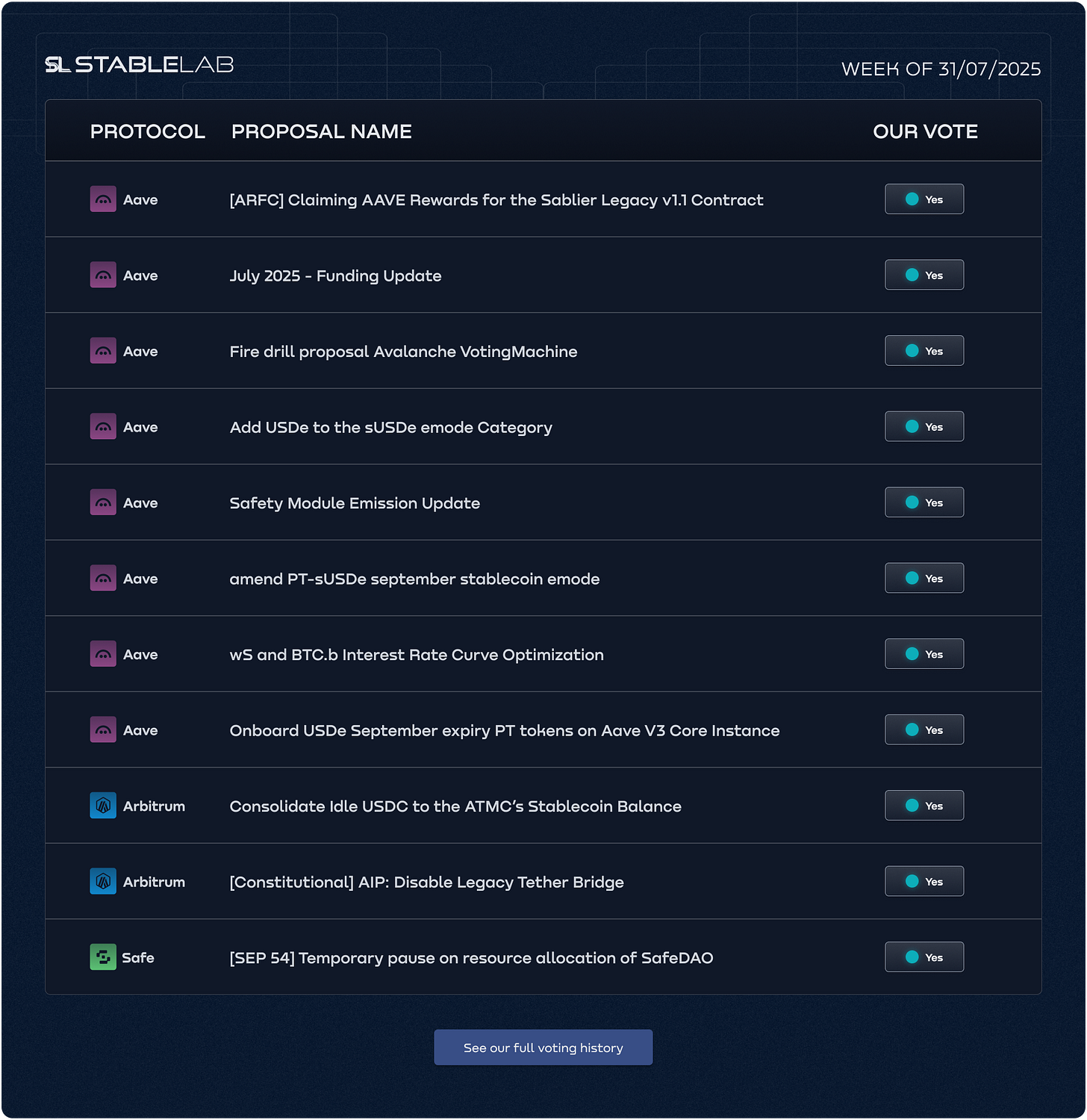

❲ Our Voting ❳

📆 July 25nd → July 31st | 🗳️ Total Votes: 11

See our full vote history and detailed rationale HERE.

Meme

I’d love to hear from you! Drop me a DM on Twitter with your thoughts, feedback, or any comments you may have about the newsletter. I write for you, the reader :)

💌 FOLLOW US

Website | Twitter | YouTube | Mirror | LinkedIn

🤝 DELEGATE TO US @ stablelab.eth

Tally | Boardroom | Linktree