👨🔬 Governance Lab #089

Lab Report #089 - Aave Aavenomics Implementation, GHO Savings Upgrade, Fluid on Polygon, and more

gm frens 👋

Welcome back to the Governance Lab, your weekly source for all things StableLab, DeFi, and DAO Governance. As always, we've filtered through the noise to bring you the governance signals (and drama) that matter.

At a Glance 👀

🏦 Aavenomics implementation begins with Anti-GHO

💰 Aave DAO looks to introduce sGHO savings product

🌊 Fluid Protocol proposes deployment on Polygon PoS

Let’s dive in 🏊

Anti-GHO

Aave DAO unveils first phase of Aavenomics implementation

The Aave community is reviewing the first phase of Aavenomics implementation, which includes updating AAVE tokenomics, protocol revenue redistribution, deprecating LEND, and revamping secondary liquidity management. The proposal follows the Aavenomics update approved in August 2024.

Key components include creating an Aave Finance Committee (AFC), introducing "Anti-GHO" (a non-transferable token for AAVE and StkBPT stakers), closing the LEND migration by redirecting 320k tokens to the ecosystem reserve, and launching an AAVE buyback program at $1M/week for six months. The proposal allocates 50% of GHO revenue to Anti-GHO generation, with 80% distributed to StkAAVE holders and 20% to StkBPT holders.

sGHO

Aave DAO discusses introducing sGHO and Aave Savings Rate

TokenLogic and ACI have presented a TEMP CHECK proposal for a GHO Aave Savings Upgrade, introducing sGHO and defining the Aave Savings Rate (ASR). This proposal aims to support GHO’s next growth phase by offering a low-risk savings product that rewards users for staking Aave’s native stablecoin.

The sGHO product features several key benefits, including an interest-compounding Aave Savings Rate, no rehypothecation to ensure instant liquidity, minimal smart contract risk, and no deposit or withdrawal fees. The ASR will be calculated using a formula (Amp × Index Rate + Premium) based on USDC Native Yield from Ethereum's Core instance. To manage risk, deposited GHO will remain in the sGHO contract, and a supply cap will be implemented to limit the DAO's financial exposure while ensuring sufficient liquidity for withdrawals.

Fluid

Fluid proposes expansion to Polygon PoS

The Instadapp team has proposed deploying Fluid on Polygon PoS as part of their multichain expansion strategy, outlining initial lending tokens, vaults, limits, and rewards. The proposal outlines initial lending tokens (USDC, USDT, POL, ETH), vault configurations, and liquidity incentives to bootstrap the ecosystem.

To bootstrap initial liquidity, Polygon will provide $1.5M in POL as lender incentives, $10M in stablecoin liquidity, and ~$25M in POL/LST liquidity. Once specific adoption metrics are achieved, including $60M in borrowed stablecoins and a consistent weekly DEX volume of $2.5B for at least two consecutive weeks, Fluid will match with $1.5M in FLUID rewards.

Links

🚀 Launches, Deployments, Partnerships, and M&A

Aave deploys on Sonic

Cork Protocol launches on Mainnet

📑 Reads, Insights, and Reports

Arbitrum DAO: The Evolution of Decentralized Governance

Thread on governance of Arbitrum DAO

Futarchy: A New Approach to Decision-Making

Wintermute DeFi Governance Digest: March 2025 | Week 1

Lido Governance Manual

Introducing Smart Capital Activation

🧗 Milestones & Updates

Aave DAO - AL Development Update | February 2025

Uniswap DAO approves Temp Check proposals — Uniswap Unleashed and Unichain and Uniswap v4 Liquidity Incentives

🔒 Security, Risk, & Hacks

Arbitrum’s Path to a Stage 2 Rollup: How BoLD Enhances Dispute Resolution, Validation, and Security

Arbitrum DAO Security Council Elections

Edge Risk Oracles: Dynamic Caps Now Live on Aave

🗞️ Everything Else

Compound DAO - 2025 Compound Growth Program V3 Consolidated

Paraswap DAO - Return of 44.67 wETH to Bybit

Paraswap DAO - Delegate Incentives Program (Cycle 1)

Arbitrum DAO - Register the Sky Custom Gateway contracts in the Router

📺 Podcasts, Presentations, & Listens

Hasu: Ethereum’s Culture Problem on Infinite Jungle

🏔️🦬🦄 ETHDenver Recordings

Governance Security Beyond Code Navigating Political, Social, and Economic Attack Vectors

Securing Liquid Staking: Lido’s Dual Governance Revolution | Tomer Ganor - Certora

The State of DAO M&A | Bernard Schmid | Jillian Grennan | Joshua Tan

DeFi & Beyond: This Is Not Financial Advice Ether Knight | Chris Bradbury - Summer.fi, Maria Magenes

Breaking Down DeFi Lending: Bring Back the Liquidity | Charles, Kirk, Dion, Alexandre, Ayesha

Proposal Tracker™️

⚡ VOTING UNDERWAY | 1inch DAO - Messari Protocol Services 1inch Proposal 2025

Summary: This proposal continues Messari's research and reporting services for 1inch Network through four Quarterly Reports at $22.5k USD each, totaling $90k for 12-15 months of collaboration. The reports will analyze financial metrics (market cap, supply, revenue), network metrics (transactions, addresses, fees), and 1inch-specific metrics (volume, staked tokens, treasury).

💬 DISCUSSION | EigenLayer - Simplification and Enhancement Of EIGEN and BackingEIGEN Token Contracts

Summary: This proposal simplifies the EIGEN and BackingEIGEN token contracts by removing deprecated transfer restrictions from the launch phase, consolidating minting functionality into BackingEIGEN, and enhancing event logging for token wrapping operations. These changes will improve contract maintainability, reduce gas costs for transfers, and provide better transparency for token operations, with implementation following a three-phase plan of development, community review with external audit, and staged deployment from testnet to mainnet.

💬 DISCUSSION | Curve DAO - Start Building a Curve DAO Treasury

Summary: This proposal addresses Curve DAO's treasury sustainability by introducing two mutually exclusive mechanisms to redirect protocol fees: either allocating all 3pool revenue to the community fund or redirecting 10% of veCRV fees (reducing APR from 3.95% to 3.55%). Currently, the DAO has only $16m in assets with $5m annual expenses, while generating $40m in revenue that's primarily (70%) distributed to governance token stakers. The proposal aims to establish sustainable funding for protocol development, maintenance, and growth while maintaining DAO control over treasury allocation decisions.

From the Lab

Blogpost - Rootstock Collective: Shaping Bitcoin Governance

Our latest blog post explores how Rootstock Collective is reshaping Bitcoin governance through decentralized decision-making. Learn how StableLab, as one of the Shepherds, is contributing to this transformation.

▶︎ READ the blogpost

Gnosis Delegate Program Candidate Voting

GnosisDAO is launching its Delegate Program – voting on candidates is now open! Coordinated by StableLab and karpatkey, this initiative will onboard 10 dedicated delegates to strengthen GnosisDAO governance. If you’re a GNO tokenholder consider voting for your preferred delegate.

▶︎ VOTE on the proposal

❲ Our Voting ❳

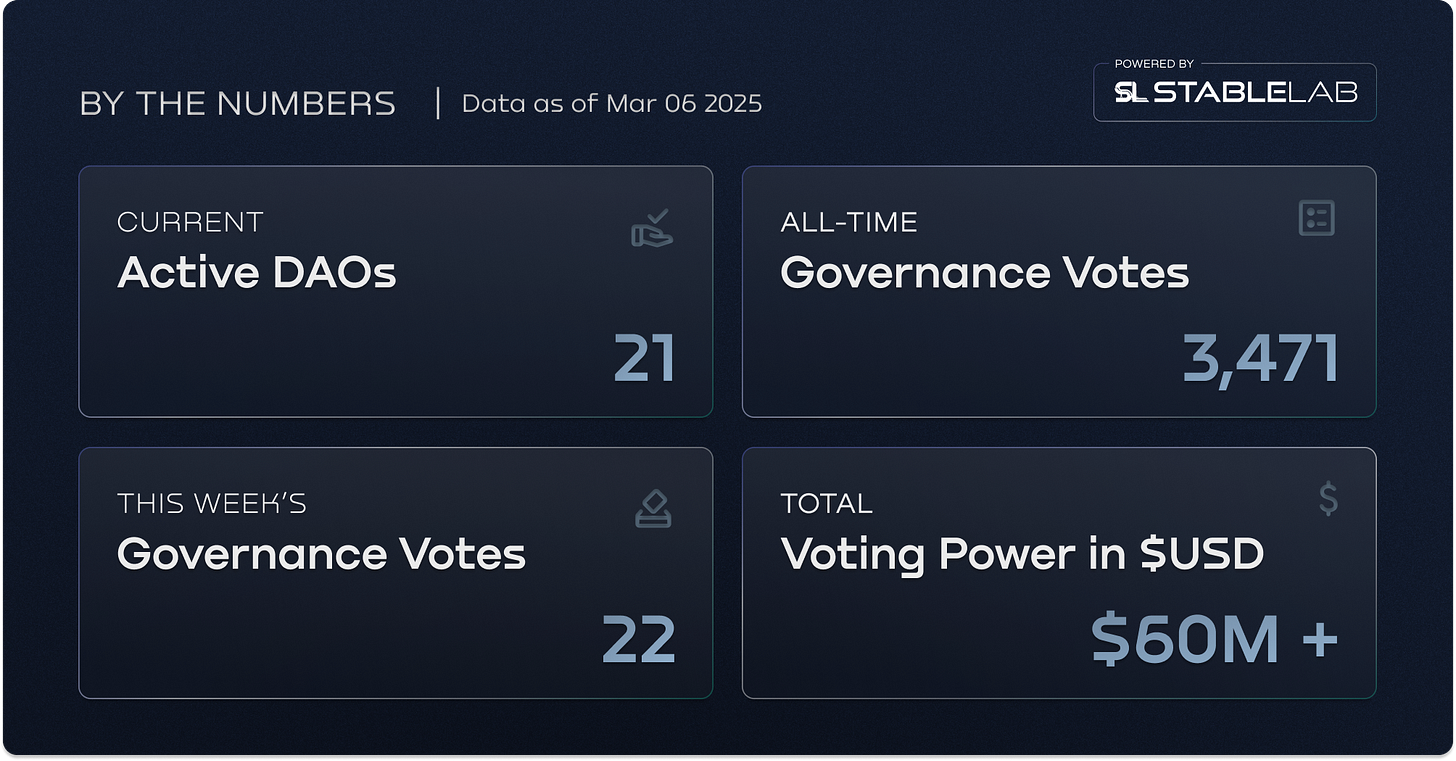

📆 Feb 28 → Mar 06 | 🗳️ Total Votes: 22

See our full vote history and detailed rationale HERE.

Meme

Forse: Empowering DAOs with Data-Driven Governance

Explore our Forse Terminals at Forse.io

ft. Sky, Spark, Arbitrum, Polygon, Ajna, and more coming soon.

💌 FOLLOW US

Website | Twitter | YouTube | Mirror | LinkedIn

🤝 DELEGATE TO US @ stablelab.eth

Tally | Boardroom | Linktree