👨🔬 Governance Lab #069

Lab Report #069 - MakerDAO rebands to Sky, Aave BUIDL GSM, Arbitrum Delegate Incentives, StablePod w/ Michael from Euler and more

gm frens 👋

Welcome back to the Governance Lab, your weekly source for all things StableLab, DeFi, and DAO Governance.

At a Glance 👀

🌌 MakerDAO rebrands as Sky

🌏 Aave DAO proposes new GHO Stability Module with BlackRock integration

🔧 Arbitrum DAO considers revamping Delegate Incentive Program

🎙️ New StablePod w/ Michael Bentley (Euler)

Let’s dive in 🏊

SKY

MakerDAO rebrands as Sky

MakerDAO has officially rebranded as Sky, with a full launch date set for September 18, 2024. The rebranding comes with significant upgrades to the protocol and ecosystem. Key elements of the Sky ecosystem include:

Two upgraded tokens: USDS (stablecoin) and SKY (governance token)

Users can swap 1 MKR to 24,000 SKY

A new website and app: Sky.money

Introduction of Native Token Rewards

Launch of Stars (formerly SubDAOs), starting with Spark

Upcoming features like Sealed Activation, Regular Activation, and Skylink (multichain solution)

The rebranding aims to reflect the protocol's evolution towards a more inclusive and versatile financial ecosystem, catering to both crypto natives and tradfi users.

GSM

Aave Governance discusses Temp Check on BUIDL GSM

Aave Labs has introduced a Temp Check proposal to build and deploy a new GHO Stability Module (GSM). The proposed GSM aims to support reserve allocation and management features for third-party integrations. Key aspects of the proposal include:

Specific support for integration with BlackRock's BUIDL infrastructure

Enabling 1:1 fixed-ratio swaps between USDC and GHO

Utilizing USDC surplus to mint BUIDL tokens

Accumulating swap fees in GHO and paying dividends monthly in BUIDL

The new GSM is designed to run parallel to existing GSMs, enhancing capital efficiency. If approved, this initiative could expand Aave's reach into RWAs and strengthen partnership opportunities with BlackRock.

Programs

Arbitrum DAO debates Delegate Incentive Program

Arbitrum DAO is evaluating a proposal to renew and improve its Delegate Incentive Program (DIP) for one year. The proposed changes aim to professionalize delegate participation and improve overall governance quality. Key aspects of the new DIP include:

A total budget of $4.2 million for delegate incentives

Introduction of a three-tier compensation structure based on Total Participation (TP)

Maximum monthly compensation of $7,000 or 16,500 ARB per delegate

Updated eligibility requirements, including >60% participation in on-chain votes in the last 90 days

Revised scoring weights for various participation metrics

New features such as Early Stage Feedback incentives and bonus points for attending governance calls

The RFC proposal has received extensive feedback from the community and is expected to be improved upon based on suggestions.

❲ Links ❳

🚀 Launches & Deployments

Introducing Rumpel

Introducing Soneium, an L2 by Sony

Lyra rebrands to Derive

Renzo announces $REZ on Solana via Wormhole

Introducing Frax Name Service

📑 Insights & Reports

Arbitrum Foundation Bi-Annual H1 2024 Report

Wintermute DeFi Governance Digest: August 2024 | Week 4

DeFi will be the backbone

🧗 Milestones & Updates

Lido Delegation: Enhancing Governance

Balancer goes Superchain

Arbitrum Subsidy Fund coming in September

Arbitrum GovHack Brussels Impact Report

🔒 Security, Risk, & Hacks

Llama Legal: Curve Decentralization Assessment

🗞️ Miscellaneous

Creating SafeDAO’s first revenue stream through Community-Aligned Fees

Gnosis DAO - Omen 2.0

Stargate on Soneium

Centrifuge Launches Institutional RWA Market on Morpho

ABC Labs invests $2.2M in Curve Ecosystem

How (and why) the Superchain drives fees to the Optimism Collective

❲ Proposal Tracker ❳

💬 DISCUSSION | Aave - Onboard USDS and sUSDS to Aave v3

Summary: This proposal seeks community feedback on the potential onboarding of USDS and sUSDS stablecoins to Aave V3. The goal is to maintain continuity for users, enhance liquidity, and provide users with more options for stablecoin utilization within the Aave ecosystem. USDS and sUSDS are rebrands of the DAI and sDAI tokens. The proposal mentions the Sky team has discussed providing both token incentives and liquidity provisioning should the token be onboarded.

💬 DISCUSSION | GMX - Implementation of Chaos Labs Risk Oracles

Summary: This proposal aims to implement a Risk Oracle from Chaos Labs to enhance the risk management framework of GMX. By integrating these oracles, GMX seeks to improve price accuracy, increase its competitiveness by improving execution costs, and reduce the potential for manipulation.

💬 DISCUSSION | Maple Finance - SYRUP Token Launch and MPL <> SYRUP Conversion

Summary: This proposal outlines the launch of the SYRUP token and the conversion process for existing MPL tokens into SYRUP. The initiative aims to enhance liquidity and incentivize participation in the Maple ecosystem. Key components include the tokenomics of SYRUP and the mechanics of the conversion process, with community input being requested before implementation.

From the Lab

Euler: Exploring v2 and the Future of Modular Lending Systems

In the latest StablePod episode, we're joined by Michael Bentley, Co-founder and CEO of Euler Labs. Michael shares the story of Euler V1's rise and fall, the team's resilience and perseverance in the aftermath of the exploit, and the innovations and improvements they've made in Euler V2. Enjoy our conversation!

Compound DAO Finalize Delegate Race - Cycle 1

Our proposal to further strengthen Compound governance is now live onchain. The proposal, which aims to finalize Cycle 1 of the Delegate Race, will delegate 300k COMP to 9 delegates from franchiser contracts controlled by the DAO. Delegates participating in the program include PGov, Arana Digital, Michigan Blockchain, Franklin DAO, and others. The proposal is an important step in expanding the DAO's delegate base following the recent attempted governance attack.

▶︎ Vote on the proposal HERE

Forse Data Categories Explainer Series: Onchain Impact Analysis

We're kicking off a series where we explain the current data categories and analysis supported on Forse. First up is Onchain Impact Analysis. This category looks at how different key on-chain metrics are impacted when defined events on a network occur. Events such as Incentive Programs, Liquidity Programs, Grant Programs, and more are analyzed and measured within this category.

Subcategories here include Total Transactions, Gas Fees, Unique Users, Total Value Transacted, and Total Value Locked.

▶︎ For the full breakdown of data supported on Forse, visit our recently launched docs site HERE

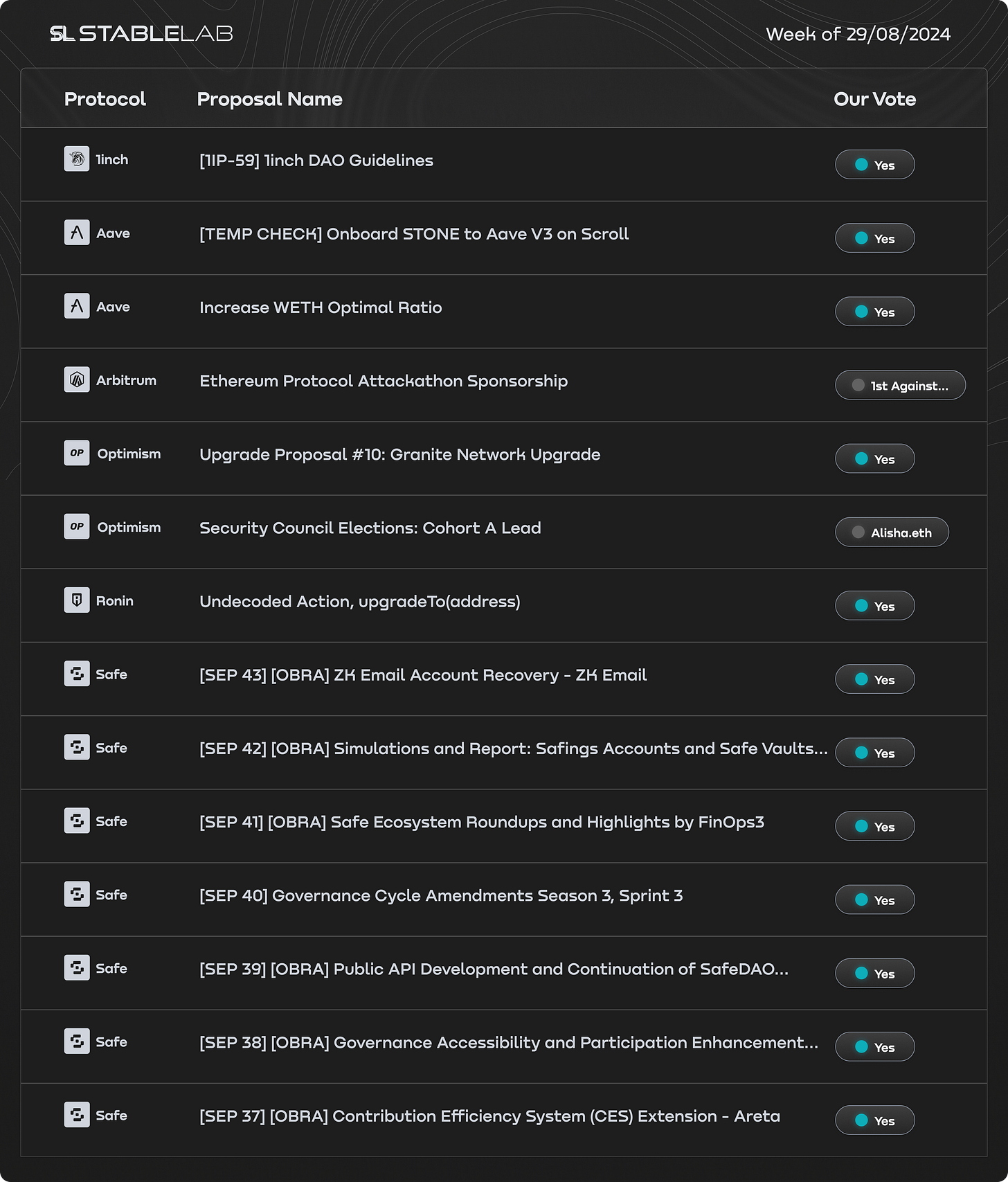

❲ Our Voting ❳

📆 August 23rd → August 29th | 🗳️ Total Votes: 14

See our full vote history and detailed rationale HERE.

Meme

I’d love to hear from you! Drop me a DM on Twitter with your thoughts, feedback, or any comments you may have about the newsletter. I write for you, the reader :)

💌 FOLLOW US

Website | Twitter | YouTube | Mirror | LinkedIn

🤝 DELEGATE TO US @ stablelab.eth

Tally | Boardroom | Linktree