👨🔬 Governance Lab #056

Lab Report #056 - Aave ARFC for GHO Cross-Chain, Arbitrum Pilot M&A, Uniswap Delegate Reward Cycle 1, StablePod w/ Thanos from Keyrock, and more

gm frens 👋

welcome back to the Governance Lab, your weekly source for all things StableLab, DeFi, and DAO Governance.

At a Glance 👀

👻 Aave DAO discusses ARFC GHO Cross-Chain

💙 Arbitrum DAO votes on Pilot M&A Unit

🦄 Uniswap DAO votes on activating Delegate Rewards

🎙️ New StablePod w/ Thanos Soutos (Keyrock)

Let’s dive in 🏊

GHO to Arbitrum

Aave Labs submits ARFC for on-chain vote to launch GHO on multiple chains, starting with Arbitrum

Following offchain approval of the GHO cross-chain strategy, Aave Labs has put forward an ARFC to officially kick off the stablecoin's multi-chain journey. Leveraging Chainlink's Cross-Chain Interoperability Protocol (CCIP), this move aims to boost GHO's accessibility, liquidity, and utility across the DeFi landscape.

The proposal outlines a lock-and-mint cross-chain model, where GHO tokens are locked on Ethereum and minted 1:1 on other chains. To minimize risk, new GHO will only be issued on Ethereum, with liquidity on other chains originating from there. Each network will have a canonical GHO version governed by Aave, with GHO Facilitators enabling liquidity onboarding from Ethereum within set capacities.

Arbitrum is slated as the first network for expansion, with 750K ARB from the Long-Term Incentive Pilot Program (LTIPP) allocated as incentives. Aave's Risk Service Provider Chaos Labs has provided analysis and recommendations for the Arbitrum rollout strategy. The proposal is expected to go live onchain in the coming days.

M&A

Arbitrum DAO votes on 8-week pilot phase for M&A unit

Arbitrum DAO is voting on a Snapshot proposal to launch an 8-week pilot phase of an M&A unit focused on identifying and executing acquisition opportunities. The pilot aims to align the DAO on strategic target areas, provide a platform for discussion, and deliver analyses on M&A value upside, strategic areas, and target examples.

With a pilot-phase first approach, the proposal, spearheaded by Bernard from Areta and created by the M&A Working Group, hopes to provide the DAO with sufficient information and analysis to make an informed decision on fully operationalizing the unit. The proposal requests a total budget of $25k ARB/month for operational costs and $2k ARB for data providers/research platforms. If approved, this pilot could pave the way for the Arbitrum DAO to expand non-organically through unique acquisition opportunities. Voting on this proposal ends on May 15th.

❲ Links ❳

🚀 Launches & Deployments

Introducing $MODE

Velodrome goes Superchain

📑 Insights & Reports

Maker Endgame: The SubDAOs

MakerDAO NewStable and NewGovTokens

Programmable Organizations

Good Token Distributions

Guiding Ethers Phoenix to its final form

🧗 Milestones & Updates

Aave Labs Receives Pushback from Community on High Price Tag

MakerDAO Protocol Economics Report March 2024

Uniswap-Arbitrum Grant Program March/April Reporting

Franklin Templeton submits Arbitrum STEP Application

dYdX Chain Staking Report Apr 2024

Uniswap Foundation 2023 Financials

Optimism Cycle 22 Grants Roundup

🔒 Security, Risk, & Hacks

Chaos Labs Oracle Risk Portal

🗞️ Miscellaneous

Introducing Entropy Advisors

Arbitrum: Thoughts on the End-Game Perpetual Incentives Program

Understanding the Berachain Governance Token (BGT)

Polygon: Call for Grant Allocators

📺 Podcasts & Listens

Michael Bentley: Reflects on $195M hack and how DeFi protocols are becoming more robust on The Scoop

❲ Proposal Tracker ❳

💬 DISCUSSION | Arbitrum - Multi-sig Support Service (MSS)

Summary: Here, Entropy Advisors propose creating a structured multi-sig framework called the Multi-sig Support Service (MSS) to facilitate Arbitrum DAO's funded programs. The goal is to reduce operational spend, increase efficiency, ensure signer competency, and reduce friction for contributors. The proposal involves electing 12 signers, creating new multi-sigs for each initiative, paying signers monthly in ARB, and re-electing annually. Additional mechanics are outlined, such as signer qualifications, removal procedures, and conflict of interest policy. An optional component proposes funding monthly Token Flow Reports for transparency. The proposed requests a budget allocation of 400,000 ARB.

💬 DISCUSSION | Uniswap - Deploy Uniswap V3 on Redstone

Summary: This proposal suggests deploying Uniswap v3 on Redstone, a new L2 for onchain games and autonomous worlds. Deploying Uniswap would provide Redstone with a DEX for trading in-game assets and tokens, facilitating the growth of its onchain economies. The proposal outlines the deployment process, including a 7-day RFC period and a snapshot vote to determine liquidity incentive allocation. If approved, the Uniswap contracts would be deployed and governed by the Uniswap DAO.

💬 DISCUSSION | Compound - Aera for Compound Service Provider Payments

Summary: This proposal suggests implementing a new payment process for Compound DAO service vendors using the Aera Vault and LlamaPay protocols. An Aera vault owned by Compound governance would hold COMP tokens, swap them for USDC stablecoins, and optionally supply the USDC to the cUSDCv3 market to earn yield. Payment streams would then be set up from the vault to vendor multisigs using LlamaPay. This aims to provide benefits like minimizing COMP price impact, generating yield for the treasury, stabilizing vendor payments in USD terms, and reducing governance overhead.

💬 DISCUSSION | Gitcoin - Continued Path to Decentralized Executive Director Elections

Summary: Here, Gitcoin discusses its governance structure and plans for electing an Executive Director starting in January 2025 as part of its path toward decentralization. The post outlines how legitimacy flows from users to token holders (Stewards) who vote on proposals and have the power to elect/remove the Executive Director. The goal is to create more accountability and sustainability for Gitcoin long-term.

From the Lab

Podcast: Keyrock: Accelerating DeFi with Deep Liquidity

In our latest StablePod episode, we’re joined by Thanos Soutos, Head of DeFi Ecosystems at Keyrock, a digital asset market maker and liquidity provider. We discuss Keyrock's engagement in governance across various DeFi ecosystems, the importance of liquidity providers having a voice in key decisions, the challenges of navigating scrutiny as a governance participant, and much more.

Proposal: Uniswap Delegate Reward Initiative - Cycle 1

We've submitted a Snapshot Temp Check proposal to officially activate Delegate Rewards at Uniswap DAO. Following the publication of findings by the Uniswap Delegate Reward Working Group, we're proposing the adoption of a compensation program designed to enhance participation quality and dedication among Uniswap delegates. The initial program will be structured as a 3-month pilot. To begin, there will be a one-week application period for eligible candidates, with a maximum of 11 delegates selected. If there are more than 11 eligible applicants, metrics such as voting participation and proposal authorship will be considered in the selection process.

The proposal requests both the budget for the initiative and retroactive rewards for participants of the Delegate Reward Working Group. In total, we are requesting 198K USD worth of UNI to fund the reward program and 64K USD worth of UNI for the retroactive rewards.

After receiving extensive community feedback, we have made adjustments to the proposal. While not perfect, the proposal is seen as a step forward in enabling, equipping, and informing the DAO with a better path for compensating the hardworking delegates. Voting on the proposal ends on May 13th.

▶︎ Read the full proposal HERE. Get involved with the conversation HERE.

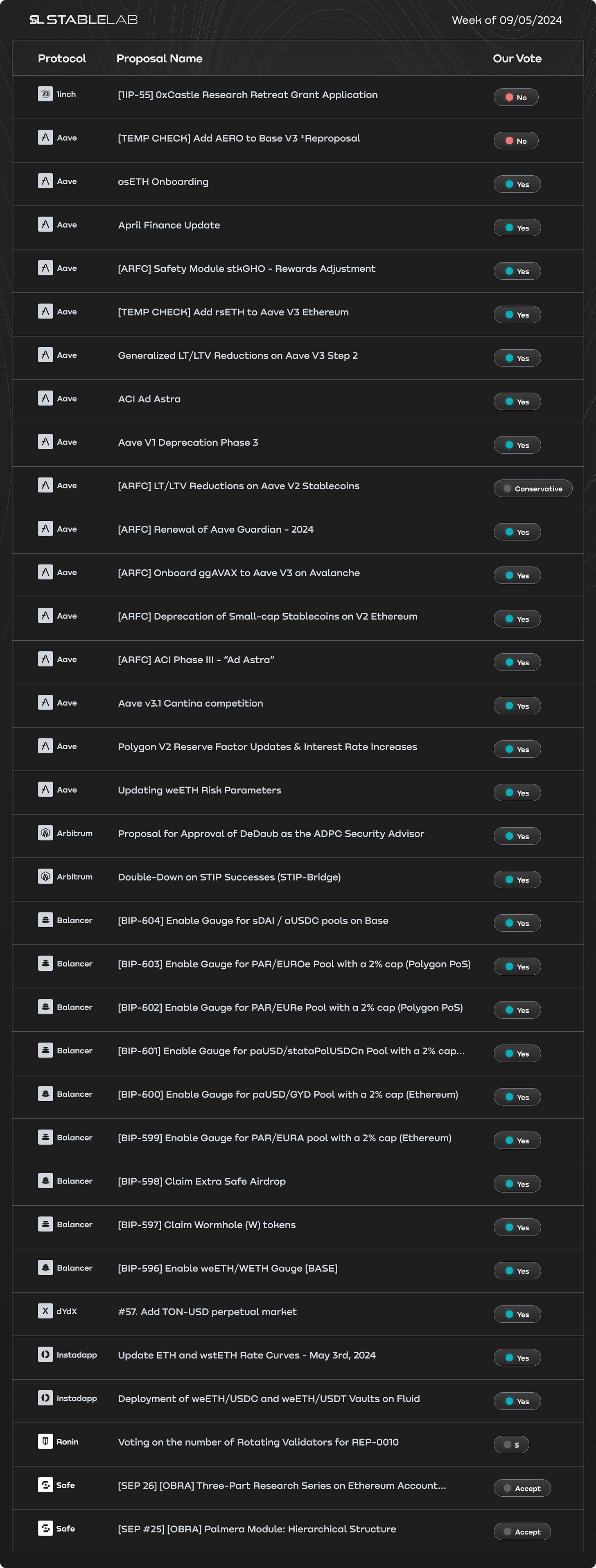

❲ Our Voting ❳

📆 May 2 → May 9 | 🗳️ Total Votes: 35

See our full vote history and detailed rationale HERE.

Meme

I’d love to hear from you! Drop me a DM on Twitter with your thoughts, feedback, or any comments you may have about the newsletter. I write for you, the reader :)

💌 FOLLOW US

Website | Twitter | YouTube | Mirror | LinkedIn

🤝 DELEGATE TO US @ stablelab.eth

Tally | Boardroom | Linktree