👨🔬 Governance Lab #028

Lab Report #028 - ARB Incentive Program, GHO Liquidity Strategy, Polygon 2.0 PIPs, and more

Welcome back to the Governance Lab, your weekly source for all things DAO Governance, DeFi, and the latest from the StableLab team. This week I was running around Austin for Permissionless so apologies for the Friday edition. Let’s keep it short and sweet so we can all go enjoy our weekend. 🎾🏸

At a Glance 👀

💸 Arbitrum DAO votes on Incentive Program

🚰 Aave DAO works on GHO liquidity

3️⃣ Polygon Labs introduces three PIPs

Let’s dive in 🏊

Show me the Incentives

Arbitrum DAO votes to introduce a short-term incentive program

Arbitrum DAO is currently voting on a proposal to introduce a community-created incentive program. The plan aims to allocate up to 75M in DAO-owned ARB for incentive distribution to Abitrum protocols. The program’s objectives include supporting network growth, exploring incentive grants, developing new grant models and developer support, & generating incentive data.

The proposal presents itself as a "short-term" solution to address the growing demand for incentives by protocols built on Arbitrum. It outlines eligibility requirements, grant budget requirements, evaluation guidelines, the timeline for grant review and distribution, and KPIs.

The DAO currently favors an initial budget of "Up to 50M ARB" for this program. Voting concludes on September 17th.

HAave you seen the Peg?

TokenLogic presents an updated GHO liquidity strategy

TokenLogic has put forth a proposal to enhance the liquidity strategy for the GHO stablecoin in order to boost the peg and promote diversification of liquidity across various exchanges.

Following initial challenges with Aave's native stablecoin GHO, including a prolonged depeg, this proposal aims to ensure stability and drive improvement. It seeks to incentivize and diversify liquidity beyond the Safety Module.

The proposal outlines the Primary and Secondary Pools being proposed for GHO. These include pools at Balancer, Maverick, Uniswap, and Curve Finance. Examples of these pools include GHO-LUSD at Maverick, GHO/USDC at Uniswap v3, and GHO/USDC/USDT & GHO/LUSD at Balancer/Aura.

In a related proposal, TokenLogic suggests the creation and funding of a GHO liquidity committee tasked with overseeing the execution of these new liquidity strategies. The proposed committee structure entails a 4 of 7 multi-sig, with an initial budget of 406K GHO allocated for a 3-month trial period.

One PIP, Two PIP, Three PIP

Polygon Labs post three improvement proposals for Polygon 2.0

Polygon Labs has published three governance proposals outlining the necessary specifications and requirements for the Polygon 2.0 upgrade.

Details on each below:

PIP-17 introduces the Polygon Ecosystem Token (POL), an upgrade to the MATIC token and the new native token of Polygon 2.0. The proposal outlines the necessary smart contract changes, the initial configurations, the token emissions, and the migration requirements. POL’s new utility includes staking, community ownership, and governance.

PIP-18 specifies Phase 0 (Frontier) of the Polygon 2.0 upgrade, a multi-phase process to upgrade the Polygon Ecosystem. This phase encompasses key milestones such as POL Upgrade, Staking Layer, Backward Compatibility, and Security Upgrades.

PIP-19 upgrades the Polygon PoS network native gas token from MATIC to POL. The proposal upgrades the Plasma Bridge contract to be able to convert all MATIC in the bridge to POL, fulfill all withdrawal requests for the native asset of the Polygon PoS Chain with POL, and credit all deposits in POL or MATIC with the native asset of the Polygon PoS chain.

❲ Links ❳

🚀 Launches & Deployments

yETH is now live

Announcing Mountain Protocol & USDM

Mauve DEX launches

Sushi expands to Aptos

crvUSD Risk Monitoring Dashboard

📑 Insights & Reports

Reflecting on our Journey with Aave

A Deep Dive Into Reserve Protocol

Frax Finance Thesis

🧗 Milestones & Updates

Balancer Treasury Report August 2023

dYdX Operations subDAO Update September 2023

🔒 Security & Hacks

Arbitrum DAO Security Council Elections Kick-Off

💰 Raises

Reverie Raises $20M Early-Stage Fund

🗞️ Miscellaneous

RFC Toward a Fully Autonomous Olympus 2.0

Polynomial OP Incentives Impact Analysis

RetroPGF3.0 Design

Surplus Management Framework at Lido DAO

Proposal to Fund Several Curve SubDAOs from the Community Fund

Vesta Finance Rage Quit Proposal by Co-founders

Fund the Endowment at ENS DAO

📺 Podcasts & Listens

Kohei Nagata: Landscape of Professional Delegates @ The DAOist Paris

Bobby Bola: Day in the Life of a Professional Delegate @ The DAOist Paris

Noun40: Unpacking the Nouns Fork on On the Other Side

❲ Proposal Tracker ❳

Notable Developments

🗳️⚡ LIVE | [ARFC] Aave Treasury Proposal for RWA Allocation

99% ‘YAE’ Vote Ends: Sep 16th 17:16 UTC

🗳️⚡ LIVE | [FIP - 285] sFRAX Governance Proposal

98.24% ‘For’ Vote Ends Sep 16th 17:33 UTC

🗳️⛓️ LIVE | Create a UNI-ARB Grant Program (UAGP) and Protocol Delegate Program

99% ‘For’ Vote Ends Sep 19th 17:33 UTC

Aave - Aave Grants DAO Continuation Proposal

Summary: This proposal seeks continued funding and expansion of the Aave Grants DAO. The proposal requests an additional allocation of 700k ARB & AAVE and 870k in stablecoins over a period of 6 months. The proposal also outlines new key objectives, such as establishing a legal entity, enhancing independence, restructuring the reviewer committee, creating subDAOs within AGD, aligning AGD and service providers, and improving the measurement of grant impact.

MakerDAO - Activation of Gnosis Chain Instance

Summary: This poll aims to ratify the rollout and activation of Spark Lend on Gnosis Chain. Risk Service Provider, Block Analitca, has thoroughly reviewed and endorsed the initial parameters for wxDAI, WETH, wstETH, and GNO, including but not limited to LTV, Liquidation Threshold, and Isolation Mode. This proposal is the first step in implementing Spark’s multi-chain strategy.

dYdX - GovernanceStrategy Smart Contract Upgrade

Summary: This proposal aims to enhance the existing dYdX v3 governance smart contract by implementing wethDYDX functionality. This new functionality will allow the wethDYDX token to be utilized for voting and proposal power. The proposal specifically outlines the replacement of the GovernanceStrategy Smart Contract with the GovernanceStrategy V2 Smart Contract. This modification will grant governance power to Wrapped Ethereum DYDX, an ERC-20 token issued at a ratio of 1:1 when users send ethDYDX to the wethDYDX smart contract. This step is crucial in preparing for the upcoming launch of V4 dYdX Chain.

Convex Finance - FXS Protocol Treasury Fee Changes

Summary: This proposal aims to enhance the sustainability of Convex by adjusting the FXS protocol treasury fee. The proposed changes include raising the fees from 17% to 20%, decreasing the clCVX share from 7% to 5%, assigning the remaining 5% of boost fees to the Treasury, and introducing a 5% fee on vsFXS fee revenue to the Treasury. These adjustments will bolster Convex's long-term viability and strengthen its Protocol-owned liquidity.

1inch - Nethermind Technical Grant Reviewer

Summary: This proposal aims to onboard Nethermind as a service provider responsible for reviewing technical grant applications at 1inch DAO. The proposal suggests the establishment of an operations council, comprising Natalia (Core Team), Jordan (Core Team), StableLab (Kene), and DAOplomats (Jenga and Baer). This group will be tasked with initiating grant reviews and communicating with the Nethermind team when a review is necessary. Netherermind will post all comments and grant feedback on the forums. The proposal is requesting a 6-month retainer amounting to $15K and a transfer of $100K to the 1inch operations multi-sig.

From the Lab

❲ Our Proposals ❳

✅ Proposals Passed

🎠 [1IP-41] Stake $1M DAI to earn yield from DAI Saving Rate

Protocol: 1inch

Status: PASSED

Results: 98% YAE

❲ Our Voting ❳

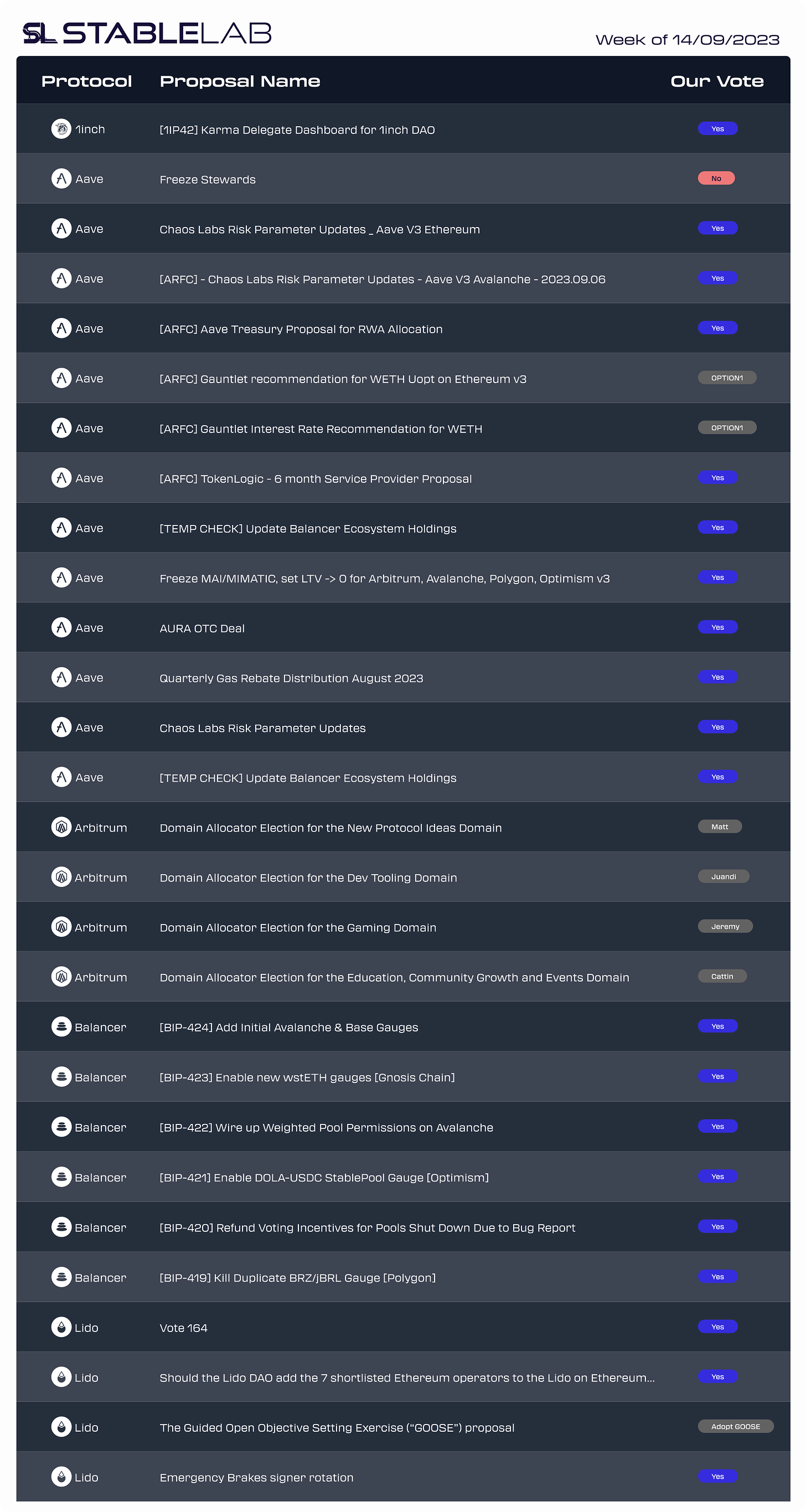

📆 September 9th → September 14th | 🗳️ Total Votes: 29

See our full vote history and rationale here.

Lab Reports 📓

Our newest blog post delves into the possibilities and challenges that may arise when DAO Governance and AI collide. What potential use cases can emerge? How can DAOs contribute to the decentralization of AI? And, as always when new technologies converge, what ethical implications lie? Explore these questions and more in our latest.

Meme

I’d love to hear from you! Drop me a DM on Twitter with your thoughts, feedback, or any comments you may have about the newsletter. I write for you, the reader :)

💌 Get in touch 💌

Website | Twitter | LinkedIn

🤝 Delegate to us @ stablelab.eth 🤝

Tally | Boardroom | Linktree