gm frens welcome back to the Governance Lab, your weekly source for all things DAO Governance, DeFi, and StableLab. The biggest stories this week: Should we ever consider using non-EVM chains for governance activities? Lido dominance… again. Incentive programs and more importantly their impact analysis are in vogue. Arbitrum kicks off Domain Allocator elections for its Ecosystem Grants Program with its rival Optimism just having recently closed submissions for Grant Cycle 15. All this and more below. Enjoy :)

P.S: If you’re in Austin next week for Permisionless HMU

At a Glance 👀

⛓️ Rune proposes NewChain run on Solana

🏦 Frax Finance introduces sFRAX

🖼️ SafeDAO revisits OBRA

🇰🇷 Doo at KBW

Let’s dive in 🏊

Pack Your Bags

Rune proposes NewChain be built on Solana codebase

Rune Christensen is once again in the spotlight for suggesting MakerDAO’s NewChain run on either Solana codebase, Cosmos, or some other possible non-EVM chain.

"NewChain" serves as the codename for an upcoming self-sustained blockchain that will be deployed as part of Phase 5 of the Endgame plan. Its purpose is to serve as the foundation for SubDAO tokenomics and governance security. One notable feature of NewChain is its ability to allow MakerDAO to hard-fork the chain in the event of severe governance attacks.

In his forum post, Rune proposes Maker explore adopting the Solana stack as a potential suitor for NewChain due to its efficiency and growing developer ecosystem. There has been some pushback within the ecosystem regarding the idea of using a non-EVM chain to facilitate the utilization of DAI, the beloved stablecoin of the Ethereum network.

Keep on Fraxing

Frax Finance debates sFRAX proposal

The Frax Core Team submitted a governance proposal this week that would introduce Staked Frax (sFRAX), a DSR-like instrument allowing FRAX depositors to earn yield.

With the sFRAX contract, users can deposit their FRAX stablecoins and earn an APR on their holdings through the "Frax Staking Rate". By depositing, users receive newly minted FRAX stablecoins as rewards, incentivizing active participation and effectively stabilizing the protocol's supply dynamics. This mechanism encourages Frax users to engage in the process of earning rewards while maintaining a stable and secure environment.

To ensure meaningful yield is available, Frax Protocol will deposit weekly into the sFRAX Vault a portion of the revenue generated from AMOs and RWAs strategies. The objective is to align with the Federal Reserve's Interest on Reserve Deposit Rate. The proposal currently sits in the community discussion phase.

C-OBRA

SafeDAO revisits the OBRA framework to align on vision and goals

As part of their requirements to enable the transferability of the SAFE token, SafeDAO is working once again on a framework that ensures clarity and consensus on core DAO activities and strategies.

Andre, from the Safe Foundation, recently released an enhanced resource allocation framework for SafeDAO. The framework, originally drafted by Pet3rpan from 1kx a year ago, has been revisited to ensure its alignment with the needs of both SafeDAO and the broader community. The framework, referred to as OBRA (Outcomes Based Resource Allocation), aims to outline and establish rules for strategic alignment, allocation focus, measurements of success, review & assessment process, and operating procedures.

In his latest post, Andre outlines more details surrounding the Strategies, Initiatives, Submissions and Review Cycles, Voting Thresholds, and other key elements essential for ensuring the effectiveness of the OBRA framework.

❲ Links ❳

🚀 Launches & Deployments

Prisma Finance is live

Introducing Pledge, a veBoost Delegation Market

Introducing Arrakis Liquid Staking Token (LST) Vaults

Oracle Provider Chronicle Protocol launches

Introducing SakuraDAO, a Maker SubDAO

📑 Insights & Reports

A Deep Dive into AMM and the AMM Landscape on Starknet

Synthetix, A New Hope

🧗 Milestones & Updates

Real World Assets (RWA) & Stablecoin Recap August 2023

Gearbox DAO Update August 2023

🔒 Security & Hacks

Aave Companies shares details on the recent GHO Freeze

🗞️ Miscellaneous

Short-Term Incentive Program at Arbitrum

The GOOSE at Lido DAO

Aera Pilot at Compound

Expansion of “Orbit” at Aave

Next Steps Tokenized T-Bills at MakerDAO

Introducing the ALCO PPG at MakerDAO

DefiEdge <> GMX Automated Liquidity Optimization

Announcing the Tokenized Asset Allocation

Introducing: dSENTRA Foundation at Reflexer

Index Coop <> Hedgey Case Study

Launch the Index Coop CoinDesk ETH Trend Index ($cdETI)

📺 Podcasts & Listens

❲ Proposal Tracker ❳

Notable Developments

✅ PASSED | V4 Adoption & DYDX Token Migration to dYdX Chain

100% ‘Yes’

✅ PASSED | [ARFC] Increase GHO Borrow Rate

100% ‘YAE’

Maple Finance - Upgrade MPL Token Design

Summary: This proposal aims to upgrade the MPL token at Maple Finance in order to enable new growth initiatives and token utility that produce sustainable and long-term growth for the protocol. According to the proposal, the issuance of new MPL tokens will occur over 3 years, realized as a one-time issuance of 10% additional tokens and a 3-year emission of 5% per annum to the Maple Treasury. The token upgrade will occur over the course of multiple months as the community and core team work on new smart contracts, audits, and migration.

Mantle - Treasury Assets in Support of Applications

Summary: Here, the Mantle Economics Committee submits a proposal to deploy a portion of the treasury to support applications on the Mantle Network. The proposal outlines several new strategies and allowances, including liquidity support for applications, seed liquidity for RWA-yield-backed stablecoins, and liquidity support for third-party bridges. The proposal also includes criteria for service providers, reporting requirements, and risk management strategies.

Arbitrum - Time Management in Arbitrum’s Governance

Summary: This proposal aims to streamline the voting process at Arbitrum DAO by scheduling all Snapshot voting to begin on the Monday of every week. The objective of this proposal is to optimize efficiency and organization within the DAO by establishing a consistent cadence for publishing proposals.

dYdX - V4 Launch Incentives Proposal

Summary: Here, Chaos Labs outlines a launch incentive program for dYdX v4. The program aims to incentivize and attract user migration of funds and liquidity over to the newly launched V4. The proposal is structured in distinct phases, including preliminary research, V4 analytics and risk portal creation, V4 rewards leader dashboard, and rewards distribution oversight. An allocation of $20M USD worth of $DYDX Tokens will be distributed among V4’s early adopters over ~6 months. The program will drive significant early adoption and help solidify dYdX’s current and future market share as an industry leader.

Stargate Finance - Make Aerodrome the STG liquidity hub on Base

Summary: This proposal seeks to adopt the recently launched Aerodrome protocol on Base as the central liquidity hub for STG. According to the proposal, $1.5m STG-USDC of POL will be bridged and locked to farm the current AERO rewards on Aerodrome. In addition, Stargate will allocate $50K worth of STG as voter incentives for its STG-USDC pool every week. The goal of the proposal is to maximize the ROI provided by the Aerodrome Rewards Program and reach a state where the DAO can sustain liquidity without needing additional STG emissions.

Curve Finance - Enable CRV rewards on a gauge for LUSD/crvUSD pool

Summary: This proposal seeks to add the LUSD/crvUSD pool to the Gauge Controller at Curve Finance. LUSD is a USD-pegged stablecoin from Liquity, a decentralized stablecoin borrowing platform. The proposal hopes to onboard this pool due to the ongoing strong synergies between the two protocols. Notably, the current LUSD/3crv pool has over $23M in TVL.

From the Lab

Doo at KBW

Our COO Doo Wan is currently running around Korea Blockchain Week. If you happen to be in town, say hello! 👋

On Tuesday, Doo had the honor of MCing the Maker SubDAO Genesis Event in Korea. Some pictures below. 😉

❲ Our Proposals ❳

🗳️ Active Proposals

🎠 [1IP-41] Stake $1M DAI to earn yield from DAI Saving Rate

Protocol: 1inch

Summary: This proposal seeks to acquire and stake $1M DAI into MakerDAO’s DSR in order to produce a meaningful yield for the 1inch DAO. As a result of recent changes at the DAO, we submitted this proposal to ensure the DAO is proactively seeking new revenue streams to sustain its growth and expansion.

Status: ⚡️ LIVE on Snapshot

Current Results: 98% ‘Yes’ Quorum: 5.7M / 10M

Voting Ends: September 10th

❲ Our Voting ❳

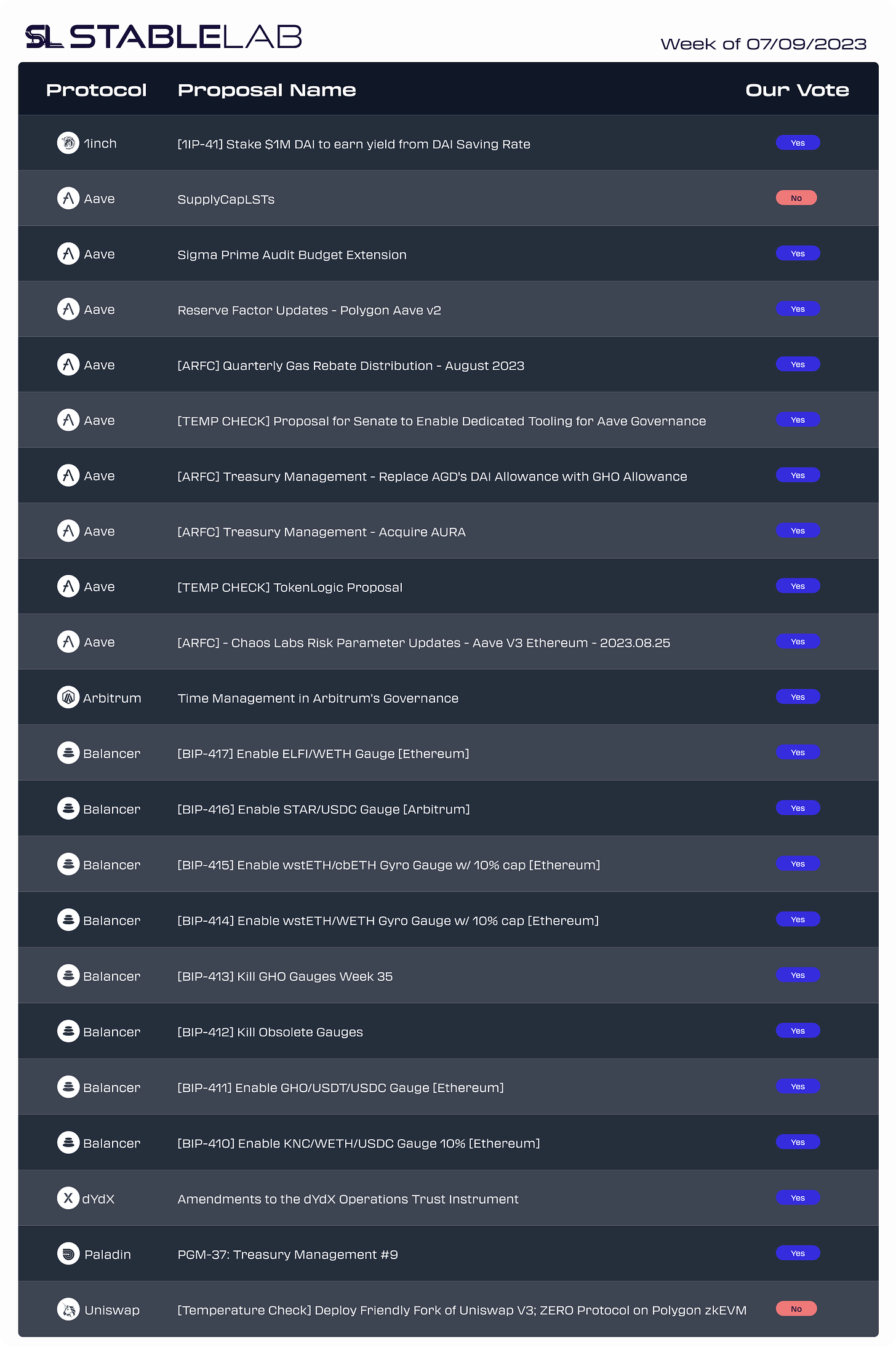

📆 September 1st → September 7th | 🗳️ Total Votes: 22

See our full vote history and rationale here.

Meme

I’d love to hear from you! Drop me a DM on Twitter with your thoughts, feedback, or any comments you may have about the newsletter. I write for you, the reader :)

💌 💌 💌 Get in touch

Website | Twitter | LinkedIn

🤝🤝🤝 Delegate to us @ stablelab.eth

Tally | Boardroom | Linktree