👨🔬 Governance Lab #022

Lab Report #022 - Curve Exploit, Aave DAO looks to Derisk, dYdX LP Reward Shift, and more

👋 gm. Welcome back to another edition of the Governance Lab, your source for all things StableLab, DeFi, and the wonderful world of Governance. I think weird is a great adjective to describe this past week. Curve was hacked. L2 Base was memed.

Let’s just get straight into it. *shakes head*

At a Glance 👀

🪫 Curve Finance Exploited

🤬 Aave DAO Debates CRV Risk

🔪 dYdX Updates its Liquidity Rewards

⚾ StableLab Delegate Pitch @ 1inch DAO

Let’s dive in 🏊

You Just Got CRVed

Curve Finance exploited for ~$70M

What: Curve Finance suffered an exploit on July 30th, resulting in a loss of approximately $70M.

Where: The liquidity Pools affected by the exploit include CRV/ETH alETH/ETH, msETH/ETH, and pETH/ETH.

Cause: Bug found in older versions of the Vyper compiler programming language

Post Mortem: Detailed post-mortem and analysis has been posted here and here.

Fallout:

OTC Deals

Curve Founder, Michael Egrove, owns approximately 50% of CRV circulating supply and borrows against these holdings across multiple DeFi protocols (Aave, Frax, Inverse, Abracadabra).

To shore up his debts, Egorov has sold over 70M CRV in OTC transactions with various large crypto players.

Fear of Contagion

Protocols with exposure to CRV have taken steps to reduce risk

Aave - Coverage below

Abracadabra - Coverage below

Controversies

The exploit has sparked various controversies and arguments including:

Arguments over live-tweeting DeFi exploits (more bad than good?)

Arguments over effective risk management from affected protocols.

Arguments over interdependence across lending protocols.

Arguments over the effectiveness of lending protocol governance. Is it simply broken or should it operate differently or not at all?

Sick Vypers

Aave DAO debates handling of CRV exposure

Aave DAO is currently debating how to handle the risk associated with a >$60M USDT loan collateralized with CRV on Aave v2, following the recent exploit of Curve.

Risk service provider Gauntlet provided the following risk recommendations and action plan:

Set CRV LTV to 0 - Voting is live on-chain

Disable CRV borrowing on v3 Ethereum and Polygon - Future AIP

Additionally, Marc Zeller submitted a proposal early Thursday to strategically acquire 5M aCRV with 2M USDT from the Aave Treasury in an OTC deal.

This is Epoch

dYdX votes to alter its liquidity rewards

dYdX governance has voted to alter the rewards paid out to market makers for providing liquidity provisioning services.

The proposal aims to lower LP rewards by 50% and increase the existing rebate from 0.5bps to 0.85bps.

Currently, dYdX pays LPs approximately $2M (1.1M DYDX) in reward incentives each epoch.

The proposal claims to save the community over $1M per month while maintaining and even increasing liquidity.

❲ Links ❳

🚀 Launches & Deployments

Announcing Lyra V2

Announcing BOLD - Permissionless Validation for Arbitrum Chains

Dullahan is Live

Unveiling Gravita x Arbitrum

📑 Insights & Reports

Cosmic Governance: Exploring dYdX Governance

Understanding Governor Bravo: A Key Tool for On-Chain Enforceability

Analysis of PoolTogether’s Incentives on Optimism

Exploring DAO Governance: A Empirical Study on Snapshot

Curve Finance: A Tale of Risk

How DEXs Are Demonstrating Their Resilience

Prisma Finance Overview

LUSD Risk Assessment

🧗 Milestones & Updates

Maker Protocol Economics Report for June 2023

Maker’s RWA Report for June 2023

Fortunafi’s RWA & Stablecoin Recap for July 2023

Analysis of Maker’s Smart Burn Engine Performance to-date

unshETH: Tokenomics and Transparency Update

Celo Passes Proposal to Transition to an L2

🔒 Security & Hacks

LeetSwap Exploited for $628K

🗞️ Miscellaneous

Aave DAO Governance Dispute [DL News]

Deploy Spark Protocol on Polygon zkEVM

Lido the “Super Aggregator”

Optimism Voting Badge Distribution v3

Arbitrum Grant Program Funding Breakdown

MakerDAO GovAlpha Emergency Response Recommendations

📺 Podcasts & Listens

Getty Hill (GFX Labs) - DAO Governance, Uniswap Fee Switch, Onchain Lending on Token Terminal Fundamentals

Sacha Yves Saint-Leger (Lido DAO) - High-Level Overview of Lido’s Dual Governance System @ The DAOist Paris

❲ Proposal Watchlist ❳

Abracadabra - Interest Rate Adjustment for the CRV Cauldrons

Summary: This proposal looks to apply a base interest rate to the existing CRV cauldrons at Abracadabra. The proposal hopes to protect the protocol from risks associated with the recent Curve Finance exploit. A 200% base rate will be applied to the current outstanding principal of $18M.

Note: The proposal failed to pass a vote and a new updated proposal has been posted.

Balancer - Allocate Base Incentives

Summary: Here, the Balancer Maxis request 50K USDC from the DAO treasury to use towards Base launch incentives. According to the proposal, the Maxis will control the funds (via a multisig) and are responsible for finding opportunities that generate value back to the DAO.

Aura Finance - Maximizing Value of Aura LP Incentives & Bootstrapping L2s

Summary: This proposal aims to optimize the distribution of AURA rewards to LPs on the Aura protocol. The proposal suggests three main changes: (i) immediate distribution of AURA pro-rata to gauges voted on in bi-weekly snapshot votes, (ii) reducing the baseline number of Aura minted per BAL for all LPs, and (iii) favoring distributions of AURA to more aligned parties likely to participate in governance.

Paladin - Extending Liquidity Mining Program

Summary: This proposal seeks to renew the current PAL liquidity mining program for an additional four months. The total budget for this renewal is 650K PAL. Paladin DAO has historically distributed nearly 2M PAL in liquidity incentives to support the growth of the protocol. The program will conclude at the end of the year once Tokenomics v2 is finalized.

GMX - V2 Genesis Parameters

Summary: This proposal seeks approval for the initial parameters of GMX V2. Chaos Labs has conducted research and evaluation of these parameters over the past few months, considering a balance between capital efficiency and risk exposure. The recommended initial parameters include 9 asset listings on Arbitrum and 7 on Avalanche.

Optimism - Intent #2 Budget Proposal 2

Summary: Here, the Grants Council at Optimism is requesting a reallocation of the remaining 2.5M OP budget as follows: 1M OP increase for Experiments, 1M OP increase for Builders, and the remaining amount for both sub-committees as a buffer. The Grants Council claims that this reallocation of funds is necessary to ensure proper funding for the remaining grant cycles this season due to a busy Cycle 13.

From the Lab

❲ This Week’s Proposals ❳

🗳️ Active Proposals

🎠 [1RDP] StableLab Delegate Pitch for the 1inch DAO

Protocol: 1inch

Status: ⚡️ LIVE on Snapshot

Results: 53% YAE Quorum: 5.2M / 10M

Voting Ends: August 5th

❲ This Week’s Voting ❳

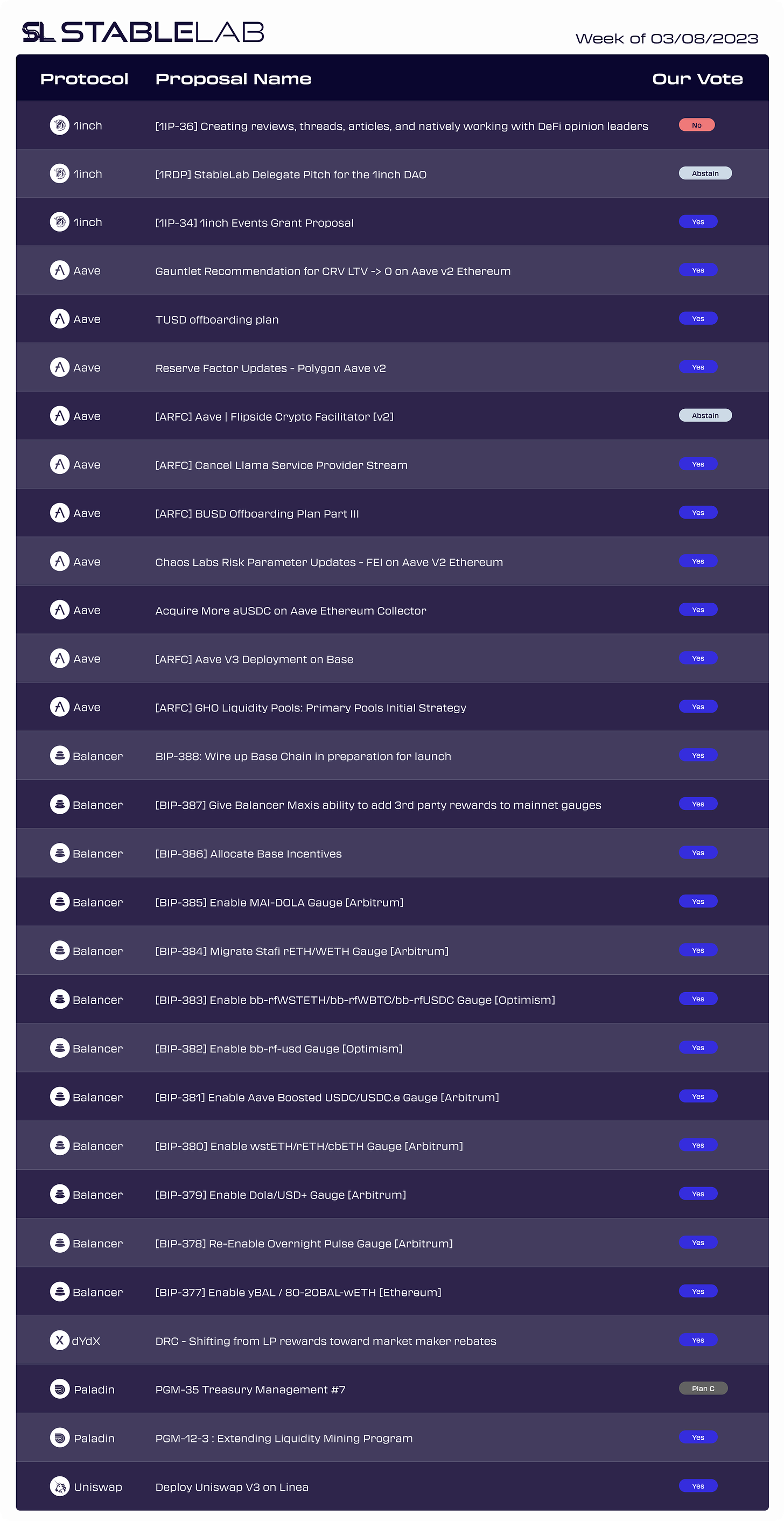

📆 July 28st → August 3rd | 🗳️ Total Votes: 26

See our full vote history and rationale here.

❲ Meme ❳

I’d love to hear from you! Drop me a DM on Twitter with your thoughts, feedback, or any comments you may have about the newsletter. I write for you, the reader :)